Loading

Get Gradual Inheritance Concept 6544-fillable - Standard Life - Advisors Standardlife

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Gradual Inheritance Concept 6544-fillable - Standard Life - Advisors Standardlife online

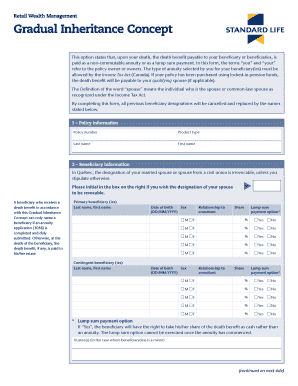

Filling out the Gradual Inheritance Concept 6544 is an essential step in managing your estate and ensuring your beneficiaries receive their inheritance as intended. This guide provides clear, step-by-step instructions to help you complete the form online with confidence.

Follow the steps to fill out the Gradual Inheritance Concept 6544 online.

- Click 'Get Form' button to obtain the Gradual Inheritance Concept 6544-fillable form and open it in your preferred editor.

- Begin by entering your policy information. Provide the policy number and product type in the designated fields.

- Fill in your personal details, including your first name and last name, to ensure proper identification as the policy owner.

- Next, complete the beneficiary information section. Specify the primary beneficiaries' names, birth dates, relationships to the annuitant, and whether they will receive their share as a lump sum.

- If applicable, add contingent beneficiaries, repeating the same process as the primary beneficiaries' section.

- In the annuity information section, select the type of annuity, guarantee option, and payment frequency. Ensure you check the appropriate boxes for your selections.

- Sign the form where indicated, acknowledging that all previous beneficiary designations are revoked. If there is more than one owner, ensure all required signatures are included.

- Review all entries for accuracy and completeness. Once confirmed, save the changes, and choose to download, print, or share the completed form as needed.

Start filling out the Gradual Inheritance Concept 6544 online today to secure your legacy.

If no money has been taken from the pension when you die Your beneficiaries can usually withdraw all the money as a lump sum, set up a guaranteed income (an annuity) with the proceeds or, they may also be able to set up a flexible retirement income (pension drawdown).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.