Loading

Get Boe-267-l1 - Kern County Assessor Recorder - Recorder Co Kern Ca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the BOE-267-L1 - Kern County Assessor Recorder - Recorder Co Kern Ca online

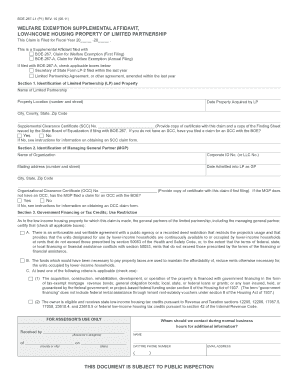

The BOE-267-L1 form is essential for claiming welfare exemptions on low-income housing properties owned by limited partnerships in Kern County. This guide will provide you with clear instructions on how to fill out this form online effectively.

Follow the steps to fill out the BOE-267-L1 form correctly.

- Use the ‘Get Form’ button to access the BOE-267-L1 document and open it in your online editor.

- Begin by filling out Section 1 to identify the limited partnership (LP) and the property. Provide the name of the limited partnership, property location, and acquisition date.

- In Section 2, enter the details of the managing general partner (MGP), including the MGP's name, corporate ID, mailing address, and admission date into the LP.

- Complete Section 3 by certifying the type of government financing or tax credits that apply to the low-income housing property. Check all applicable boxes.

- For Section 4, provide household information, including maximum income limits for the number of persons in each household and a list of qualified households.

- In Section 5, check the relevant boxes that confirm the managing general partner’s designation and material participation in the partnership.

- Proceed to Section 6 to indicate any delegation of authority regarding management duties within the partnership.

- Finally, complete the certification section, ensuring that the signatures of the managing general partner and all general partners are obtained. Verify that all information is correct.

- Once all sections are filled, save any changes, download the completed form, and prepare for printing or sharing as required.

Complete and file the BOE-267-L1 form online to ensure you receive the appropriate welfare exemption.

The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place of residence of the owner on the lien date, January 1st.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.