Loading

Get Boe-261-g - Kern County Assessor Recorder - Recorder Co Kern Ca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the BOE-261-G - Kern County Assessor Recorder - Recorder Co Kern Ca online

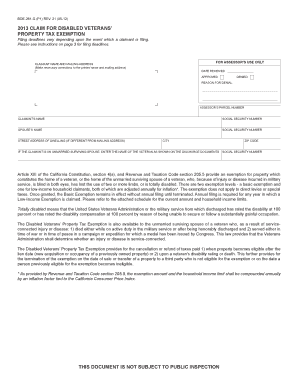

This guide provides clear instructions on completing the BOE-261-G form, which is essential for claiming the Disabled Veterans’ Property Tax Exemption in Kern County. By following these steps, users will successfully navigate the online filing process.

Follow the steps to fill out the BOE-261-G form accurately.

- Click the ‘Get Form’ button to access the BOE-261-G form and open it in your online editor. Ensure you are on a secure, stable connection for a smooth process.

- Verify your name and mailing address on the form. Make any necessary corrections to ensure accurate information is provided.

- Enter the Assessor's Parcel Number and check that the printed details are correct. This identifies the property for which you are claiming the exemption.

- Complete the claimant name section with your information. If claiming as an unmarried surviving spouse, remember to include the veteran's name as shown on their discharge documents.

- Provide your Social Security Number along with the spouse's name and their Social Security Number if applicable.

- Fill in the street address of your dwelling if it is different from your mailing address, along with the city and zip code.

- Answer the questions in the Statements section related to property acquisition dates and prior claims. Mark 'yes' or 'no' as applicable.

- Input your effective date of disability and the date received from the United States Department of Veterans Affairs.

- Select the basis for your claim based on your situation by checking the appropriate boxes provided in the form.

- If claiming the Low-Income Exemption, calculate your yearly household income and enter the amount on the form. Ensure this amount meets the income limits specified.

- Read and complete the certification section to affirm that the information provided is true and accurate to the best of your knowledge.

- Finally, save your changes, and choose the option to download, print, or share your completed form as necessary to ensure submission.

Complete your BOE-261-G form online to ensure you benefit from the Disabled Veterans’ Property Tax Exemption!

As of April 1, 2021, Proposition 19 allows persons over 55, or severely disabled of any age, to transfer the "taxable value" of their primary residence to a replacement residence anywhere in the state.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.