Loading

Get Fbr Paksirtan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fbr Paksirtan online

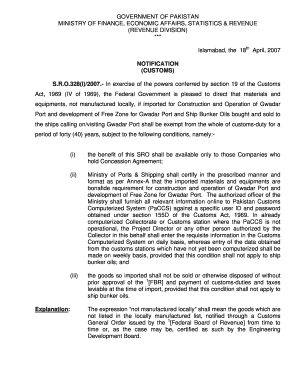

Filling out the Fbr Paksirtan form is an essential step in exempting materials and equipment imported for the construction and operation of Gwadar Port from customs duties. This guide provides a clear and structured approach to ensure users can complete the form accurately and efficiently.

Follow the steps to fill out the Fbr Paksirtan form

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the header information at the top of the form. This includes the NTN/FTN of the importer and the approval number, which are crucial for identification and processing.

- In the section detailing materials and equipment, the authorized officer of the Ministry of Ports & Shipping must enter specifics such as the description, HS code, quantity imported, and applicable duty rate.

- Ensure to provide the unit of measure (UOM) and relevant certifications confirming that the imported goods are a genuine requirement for the Gwadar Port project.

- The final section requires the authorized officer to sign and add their designation, certifying the authenticity of the information provided in the form.

- Once all sections are completed, review the information for accuracy. You can then save changes, download, print, or share the form as needed.

Start completing your documents online today to ensure a smooth submission process.

The FIRS core functions are to assess, collect, remit and account for the Federations taxes. The only Oil and Gas specific tax collected and remitted to the Federation Account is the Petroleum Profit Tax (PPT).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.