Loading

Get Central Excise Series No 2aa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Central Excise Series No 2aa online

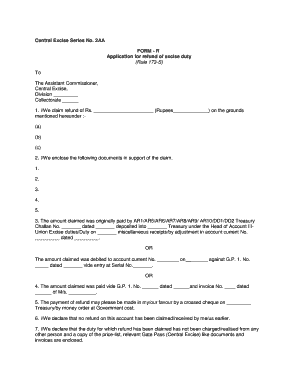

Filling out the Central Excise Series No 2aa form is an essential process for users seeking a refund of excise duty. This guide provides a detailed walk-through, ensuring that you understand each step and section of the form as you complete it online.

Follow the steps to accurately complete the Central Excise Series No 2aa form online.

- Select the ‘Get Form’ button to access the Central Excise Series No 2aa form and open it in the online editor.

- In the address section, fill in the name of the Assistant Commissioner and the relevant division and collectorate.

- Specify the amount you are claiming as a refund, in both numeric and word format.

- List the grounds for the refund claim in section one, providing clear and concise explanations for each point.

- Attach any supporting documents that bolster your claim, ensuring you list them in the specified section.

- Detail the payment history associated with the claimed refund, including Treasury Challan number, date, and the account into which the payment was made.

- Indicate how you wish to receive the refund, either via crossed cheque or money order, including any necessary details.

- Confirm that no prior claims for the same refund amount have been made.

- State that the duty for which you are claiming the refund has not been charged to anyone else and include copies of relevant documents.

- Provide an undertaking regarding the necessary refunds, if applicable, and clarify the status of the goods received after payment.

- Finally, review your filled form for accuracy, and save your changes. You can choose to download, print, or share the completed form.

Begin filling out your Central Excise Series No 2aa form online to ensure a smooth and efficient refund process.

Section 11B (2) (a) of Central Excise Act, 1944 provides that if the refund filed under Section 11B (1) is related to rebate of duty of excise on excisable goods exported out of India or on excisable materials used in the manufacture of goods which hare exported out of India, then the amount of refund would not be ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.