Loading

Get What Does Form 4924 Rev 05 13

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the What Does Form 4924 Rev 05 13 online

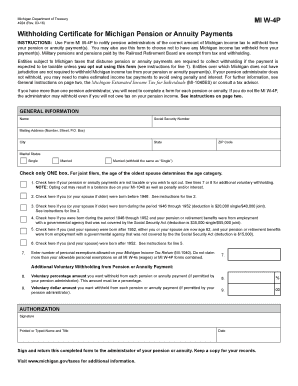

This guide provides clear, step-by-step instructions for completing the Withholding Certificate for Michigan Pension or Annuity Payments (Form MI W-4P) online. By following these guidelines, you will ensure that your pension or annuity payments are correctly withheld for Michigan income tax.

Follow the steps to fill out Form MI W-4P accurately.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter your personal information including your name, social security number, mailing address, city, state, and ZIP code.

- Indicate your marital status by checking one of the boxes: Single, Married, or Married (withhold the same as 'Single').

- For line 1, check the box if your pension or annuity payments are not taxable or if you wish to opt out of withholding.

- For line 2, check if you (or your spouse if older) were born before 1946.

- For line 3, check if you (or your spouse if older) were born between 1946 and 1952.

- For line 4, check if you were born between 1946 and 1952 and received benefits from a governmental agency exempt from Social Security.

- For line 5, check if you and your spouse (if applicable) were born after 1952 and are now age 62, and received benefits from an exempt governmental agency.

- For line 6, check if you (and your spouse) were born after 1952.

- Enter the number of personal exemptions allowed on line 7, ensuring it does not exceed allowable limits.

- For line 8, specify any additional voluntary percentage withholding you want from your pension or annuity payments.

- For line 9, if permitted, enter a voluntary dollar amount you want withheld from each payment.

- Provide your signature, printed or typed name, and date on the authorization section.

- After completing all fields, save changes, and download or print the form as needed before submitting it to your pension administrator.

Start filling out your Form MI W-4P online today to manage your pension or annuity tax withholding effectively.

INSTRUCTIONS: Use Form MI W-4P to notify administrators of the correct amount of Michigan income tax to withhold from your pension or annuity payment(s). You may also use this form to choose not to have any Michigan income tax withheld from your payment(s).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.