Loading

Get Mra Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mra Form online

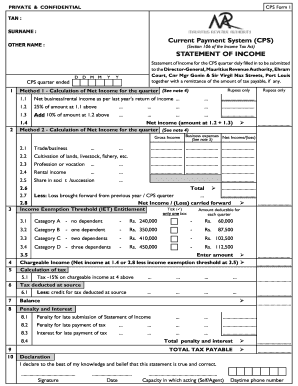

Filling out the Mra Form online is an essential process for individuals reporting their income in Mauritius. This guide will walk you through each component of the form step-by-step to ensure your submission is accurate and complete.

Follow the steps to complete the Mra Form with ease.

- Click the ‘Get Form’ button to download the Mra Form and open it in your document editor.

- Begin with Section 1, where you will enter your Tax Account Number (TAN) and your surname.

- Fill in any additional names and the quarter ending date. Ensure the date is formatted correctly to avoid errors.

- In the Statement of Income section, choose between Method 1 and Method 2 for calculating your net income. If you select Method 1, only fill out part 1; for Method 2, focus on part 2.

- Complete the relevant fields under either method, ensuring you provide accurate income, losses, and related financial data.

- If applicable, indicate your Income Exemption Threshold entitlement by selecting the appropriate category based on your dependents.

- Proceed to calculate your chargeable income and fill out the tax calculation, which is typically 15% of your chargeable income.

- Review the penalty and interest section if you anticipate late submissions or payments to ensure you are prepared.

- Finally, review your entire form for accuracy, sign it, and enter the date. Ensure you document your daytime phone number for any follow-up communications.

- Once completed, save the changes, and then you can download, print, or share the form as needed.

Complete your Mra Form online today to ensure timely and accurate submission of your income statement.

Personal income tax rates As of 1 July 2022, the rate of 10% is now applicable to annual net income not exceeding MUR 700,000. An individual deriving annual net income between MUR 700,000 and MUR 975,000 will now be taxed at 12.5%. Net income derived above MUR 975,000 will be taxed at 15%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.