Loading

Get Form I4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form I4 online

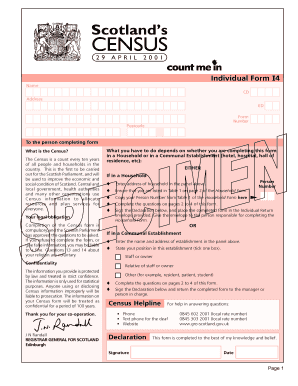

Completing the Form I4 is essential for contributing to the census data that informs important government planning and resource allocation. This guide will provide you with step-by-step instructions to fill out the form online accurately and efficiently.

Follow the steps to complete the Form I4 online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Identify whether you are completing the form as part of a household or in a communal establishment. If in a household, enter the address in the designated panel at the top of the form.

- For household completions, ensure that you are listed in the household form's Table 1 and copy your Person Number from that table.

- Proceed to fill out the questions on pages 2 to 4 of the form, providing all required information clearly and accurately.

- Once all questions are completed, sign the Declaration at the bottom of the form.

- Follow the instructions provided and place the completed form in the designated Individual Return envelope. Ensure it reaches the person responsible for the household form.

- For those in a communal establishment, enter the establishment's name and address, along with your position, and complete the necessary questions on the following pages.

- Sign the Declaration provided and return the form to the manager or person in charge of the establishment.

- After reviewing the completed form, you can save your changes, download a copy for your records, print it, or share it as needed.

Complete your Form I4 online to contribute to the important census and ensure your information is accounted for.

If you don't fill out a new W-4, you employer will definitely still give you a paycheck. But they'll also withhold income taxes at the highest rate for single filers, with no other adjustments.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.