Loading

Get Nparp

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nparp online

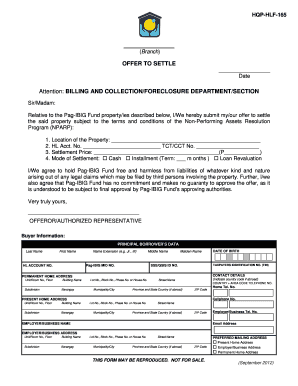

This guide will assist you in completing the Nparp form, designed for settling non-performing assets with the Pag-IBIG Fund. By following these clear, step-by-step instructions, you will be able to effectively navigate and fill out the required information.

Follow the steps to successfully complete the Nparp form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor. This will provide you with access to the necessary fields to fill out the Nparp accordingly.

- Begin by providing the property location where indicated, ensuring that all information is accurate.

- Fill in the HL Account Number and the TCT/CCT Number, as requested in the designated fields.

- Enter the proposed settlement price in the appropriate section, and clearly state the amount in Philippine pesos.

- Select the mode of settlement by checking the appropriate option for cash, installment, or loan revaluation, and specify the term if applicable.

- Review the statement agreeing to hold the Pag-IBIG Fund free from liabilities and understand that the offer is subject to approval.

- Provide your information as the offeror or authorized representative, including your last name, first name, date of birth, and other personal details such as your Pag-IBIG MID number and Taxpayer Identification Number.

- Fill out the contact details carefully, including your permanent and present home addresses, ensuring that all fields are completed correctly.

- Complete the employer/business information section with the required details as applicable.

- If applicable, provide legal heir’s information following the same format as the principal borrower’s data.

- Once all fields are filled, review the entire form for accuracy and completeness before submission.

- Finally, save changes, download, print, or share the completed form according to your needs.

Complete your Nparp form online to take the first step towards settlement!

What is loan restructuring? It is a method used by businesses, individuals, and even governments to avoid defaulting on current debts by negotiating reduced interest rates. When a debtor is in financial distress, loan restructuring is a less expensive alternative to insolvency.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.