Loading

Get Mo Govform556 D

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mo Govform556 D online

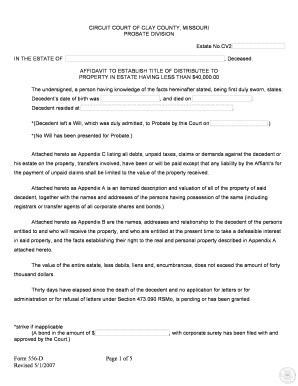

Filling out the Mo Govform556 D online can be a straightforward process if you have the right guidance. This form is used to establish title to property in an estate valued at less than $40,000. Follow these steps to successfully complete the form.

Follow the steps to complete the Mo Govform556 D online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering the decedent's date of birth and date of death in the designated fields. Ensure these dates are accurate as they are crucial for the estate review process.

- Fill in the decedent's last known address. This information is necessary for identification and probate purposes.

- Indicate whether the decedent left a will. If applicable, note the date when the will was admitted to probate; otherwise, check the option for 'No Will.'

- Prepare Appendix A by providing an itemized description and valuation of all property belonging to the decedent, including names and addresses of individuals possessing any of this property.

- Complete Appendix B. List the names, addresses, relationships to the decedent of all individuals entitled to inherit, and include details about those who may hold a defeasible interest in the property.

- Compile relevant debts, unpaid taxes, and claims against the estate for Appendix C. Ensure to document that these debts will be settled as needed.

- Confirm that the total value of the estate does not exceed $40,000 after accounting for debts and encumbrances.

- Select whether to waive bond, as applicable, and ensure to note the amount of any bond that has already been filed if required.

- Review all information for accuracy and completeness, then provide your signature as the affiant.

- Finally, you can save your changes, download the filled-out form, print it for submissions, or share it if necessary.

Start completing the Mo Govform556 D online today to efficiently manage estate-related documentation.

The Military Spouses Residency Relief Act (MSRRA) lets you keep the same state of legal residence as your service member spouse. This way, multiple states and tax localities won't tax you when your spouse moves for military service.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.