Loading

Get Property Tax Professional Taxing Unit Application - Texas ... - Tdlr State Tx

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Property Tax Professional Taxing Unit Application - Texas online

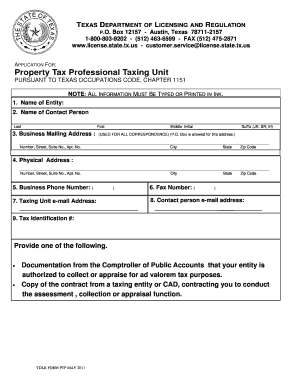

Completing the Property Tax Professional Taxing Unit Application is a crucial step for entities seeking to manage property tax assessments in Texas. This guide will provide a clear, step-by-step approach to help users fill out the application form online effectively.

Follow the steps to complete your application effortlessly.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Provide the name of the entity in the designated field. Ensure that the name is spelled correctly as it is essential for identification purposes.

- Enter the name of the contact person. Fill in the last name, first name, middle initial, and any applicable suffix.

- Complete the business mailing address section. Include the street number, suite number if applicable, city, state, and zip code. A P.O. Box is acceptable for correspondence.

- Fill in the physical address of the business, ensuring accuracy in all details including the number, street, suite number, city, state, and zip code.

- Enter the business phone number in the designated area, ensuring that the format is correct for consistent communication.

- Provide the fax number if applicable, using the standard format.

- Input the contact person's email address to facilitate direct communication.

- Enter your Tax Identification Number in the appropriate field, making sure it is accurate.

- Attach the required documentation. You can provide either documentation from the Comptroller of Public Accounts indicating authorization for ad valorem tax purposes or a copy of the contract with a taxing entity or CAD for assessment and collection.

- Thoroughly review all the provided information for accuracy and completeness.

- Once all fields are filled, save your changes. You can download, print, or share the completed application as necessary.

Complete your Property Tax Professional Taxing Unit Application online today for seamless processing.

For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax Code Section 11.13(d) allows any taxing unit to adopt a local option residence homestead exemption. This local option exemption cannot be less than $3,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.