Loading

Get October 2013 P-521 Request For Copies Of Tax Returns Or Forms W-2 - Dor State Wi

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the October 2013 P-521 Request For Copies Of Tax Returns Or Forms W-2 - Dor State Wi online

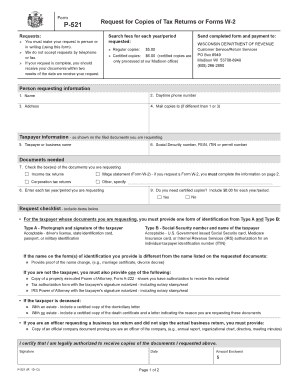

Filling out the October 2013 P-521 form is an essential process for individuals seeking copies of their tax returns or Forms W-2 from the Wisconsin Department of Revenue. This guide provides clear, step-by-step instructions to ensure successful completion of the form online.

Follow the steps to accurately fill out the P-521 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete the first section labeled 'Person requesting information' by providing your name, daytime phone number, and address. If you want the copies mailed to a different address, fill out that section as well.

- In the 'Taxpayer information' section, fill in either the taxpayer's or the business name and the corresponding Social Security number, FEIN, ITIN, or permit number.

- For the 'Documents needed' section, check the boxes for the documents you are requesting, including income tax returns or Form W-2. If you select Form W-2, ensure to complete the additional information required on page 2.

- Specify the tax years or periods for which you are requesting copies in the designated area.

- Indicate whether you need certified copies by selecting 'Yes' or 'No.' If yes, remember to include the additional fee of $6.00 for each year or period requested.

- Review the request checklist to ensure that you have included necessary identification documents and any additional requirements based on the situation, such as proof of name change or authorization forms if not the taxpayer.

- Sign and date the form, and enter the amount of payment enclosed.

- Once you have completed the form, save your changes, and proceed to download, print, or share the form as needed.

Complete your document requests online today for a smoother process.

The IRS offers two ways for you to receive your tax information via transcript free of charge – online or by mail with it's Get Transcript service. With either option, you'll need to supply personal information, such as your Social Security number (SSN), date of birth and your mailing address.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.