Loading

Get Parent/child Exclusion From Reappraisal Form - Arcc - State Of ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Parent/Child Exclusion From Reappraisal Form - ARCC - State Of ... online

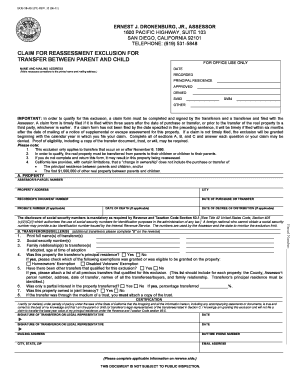

This guide provides clear, step-by-step instructions on completing the Parent/Child Exclusion From Reappraisal Form, designed for users with varying levels of experience. By following this guide, you will ensure that the form is filled out correctly, helping you to navigate the exclusion process with confidence.

Follow the steps to accurately complete the form.

- Click ‘Get Form’ button to obtain the form and open it.

- Review the printed name and mailing address on the form. Make any necessary corrections to ensure accuracy.

- Complete section A by providing the Assessor’s parcel number, property address, city, and recorded document number. Also include the date of purchase or transfer and any applicable probate number or date of death.

- In section B, list the transferors or sellers. Include their full names, social security numbers, family relationships to the transferees, and whether the property was the transferor’s principal residence. Indicate any exemptions that were granted or eligible for the property.

- Answer questions regarding previous transfers, partial interest transfers, and joint tenancy. Attach any required documents, such as copies of trusts if applicable.

- In the certification section, read the declaration carefully. Sign and date the form, providing your mailing address, daytime phone number, and email address.

- Proceed to section C and fill in the details for transferees or buyers including their full names and relationships to transferors. Answer relevant questions regarding stepfamily situations and confirm legal relationships.

- If necessary, allocate exclusions for any real property exceeding the specified value limits. This should be attached as an additional note.

- Complete the additional transferors and transferees sections if necessary. Ensure every person involved is accounted for and their information is correct.

- Once all sections have been filled out accurately, save your changes. You can download, print, or share the completed form as needed.

Take the necessary steps to complete your documents online confidently.

This option is also known as the Gonsalves-Deukmejian-Petris Property Tax Assistance Law. If you are a California resident 62 or over, are a low-income resident, and/or have qualifying disabilities, you may be able to apply for cash assistance from the state for property taxes. What is this?

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.