Loading

Get Form 982 (rev. February 2008) - Internal Revenue Service

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 982 (Rev. February 2008) - Internal Revenue Service online

Filling out Form 982 can be essential for individuals seeking to exclude certain discharged debts from their gross income. This guide provides step-by-step instructions to help users complete this form online with clarity and confidence.

Follow the steps to fill out Form 982 online successfully.

- Press the ‘Get Form’ button to acquire the form and access it in your preferred online editor.

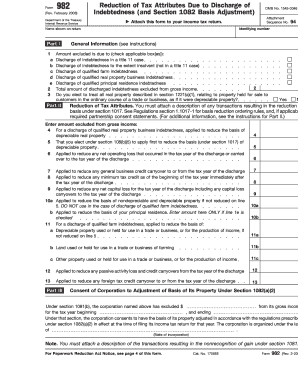

- Begin by identifying if the discharged debt falls under the applicable categories by checking the relevant box on line 1. This includes options for title 11 cases, insolvency, qualified farm indebtedness, real property business indebtedness, or qualified principal residence indebtedness.

- On line 2, enter the total amount of discharged indebtedness that you wish to exclude from gross income, ensuring it aligns with the checked category from step 2.

- If you checked line 1e regarding qualified principal residence indebtedness, also complete line 10b with the appropriate reduced basis amount corresponding to the exclusion under section 108.

- For any other types of debt, proceed to Part II of the form to report reductions in tax attributes following the prescribed order listed between lines 6 and 13.

- Complete Part III if applicable, including additional information regarding the consent of the corporation to adjust the basis of its property under section 1082.

- Before finalizing, review all entries for accuracy and ensure all relevant fields are completed according to your discharge circumstances.

- Once satisfied, you can save your changes, download a copy of the completed form, print it, or share it as necessary.

Take action today and complete your Form 982 online to take advantage of the exclusions available to you.

Purpose of Form However, under certain circumstances described in section 108, you can exclude the amount of discharged indebtedness from your gross income. You must file Form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.