Loading

Get Section 78

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Section 78 online

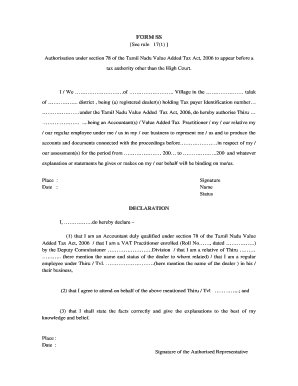

Filling out the Section 78 form under the Tamil Nadu Value Added Tax Act can be straightforward with the right guidance. This guide will walk you through each component of the form to ensure that you complete it accurately and efficiently.

Follow the steps to fill out Section 78 online.

- Press the ‘Get Form’ button to acquire the form and open it in your editing tool.

- Begin by filling in your name and the village where you reside. Specify the taluk and district to provide your complete address.

- Enter your Taxpayer Identification Number, which is essential for identification under the Tamil Nadu Value Added Tax Act, 2006.

- Designate the representative who will act on your behalf. Indicate whether they are an accountant, VAT practitioner, employee, or relative, and provide their name.

- Detail the authority under which this representative will act, including the specific tax authority, and the assessment period in question.

- Fill in the place and date sections, ensuring that the entries reflect the current dates and location of submission.

- Affix your signature at the designated area, followed by your printed name and status.

- Complete the declaration section by confirming your relationship to the dealer and your role, whether an accountant or a VAT practitioner, and provide the relevant roll number if applicable.

- Finalize by signing as the authorized representative, ensuring all entries are correct and reflective of your capacity.

- Review all entries for accuracy before saving your changes. You can then download, print, or share the filled form as required.

Complete your Section 78 form and submit it online to ensure a smooth experience with your tax authority.

Qualifying Foreign Taxes You can claim a credit only for foreign taxes that are imposed on you by a foreign country or U.S. possession. Generally, only income, war profits and excess profits taxes qualify for the credit. See Foreign Taxes that Qualify For The Foreign Tax Credit for more information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.