Loading

Get Iht400 Calculation

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iht400 Calculation online

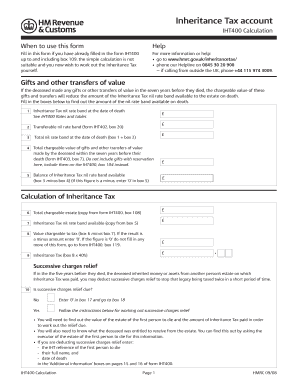

The Iht400 Calculation form is essential for calculating the Inheritance Tax due on an estate. This guide will provide clear, step-by-step instructions to help you fill out the form accurately and efficiently.

Follow the steps to complete your Iht400 Calculation form.

- Press the ‘Get Form’ button to access the form and launch it in your editor.

- Begin filling in the details by referencing the Inheritance Tax nil rate band at the date of death, as indicated in the first section. Enter the amount accordingly.

- Next, indicate the transferable nil rate band, which is found on form Iht402, and enter the value in the specified box.

- Calculate the total nil rate band available by adding the amounts in box 1 and box 2. Enter this value in the designated space.

- Provide the total chargeable value of gifts and other transfers made by the deceased within the seven years prior to their death, referencing form IHT403 as needed.

- Calculate the balance of the Inheritance Tax nil rate band available by subtracting the total chargeable value of gifts (box 4) from the total nil rate band (box 3). If this figure is negative, enter '0' in box 5.

- Complete the calculation of the Inheritance Tax by inputting the total chargeable estate from box 108 of the IHT400 forms. Review the figures you have noted so far to ensure accuracy.

- Determine if successive charges relief applies by answering the corresponding question. If applicable, gather the necessary information to facilitate further calculations.

- Finalize calculations and double-check entries to confirm that all required fields and sections have been completed accurately.

- Once all entries are made, save changes, download the completed form, or print it for your records. Ensure you keep a copy for your personal files.

Start filing your Iht400 Calculation online to ensure a smooth process.

This is referred to as an 'excepted estate' for inheritance tax purposes. There are broadly three types of excepted estate: Low value – the aggregate of the gross value of the estate and certain lifetime transfers does not exceed the nil rate band.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.