Loading

Get Ets Form 150 Power Of Atty.doc. D-2848 Poa30

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the ETS Form 150 Power Of Atty.doc. D-2848 POA30 online

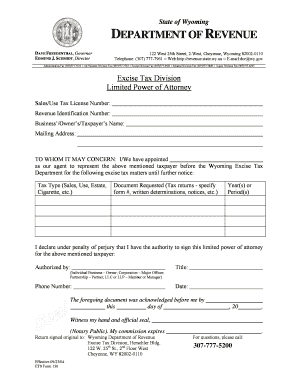

Filling out the ETS Form 150 Power Of Atty.doc. D-2848 POA30 is essential for taxpayers who wish to authorize someone else to represent them before the Wyoming Excise Tax Department. This guide provides clear, step-by-step instructions to assist users in effectively completing this form online.

Follow the steps to fill out the form accurately and efficiently.

- Click the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Enter the sales/use tax license number in the designated field to identify the taxpayer's account.

- Fill in the revenue identification number specific to the taxpayer for clarity on records.

- Input the business’s, owner’s, or taxpayer’s name in the corresponding field to ensure proper authorization.

- Provide a complete mailing address for the taxpayer to facilitate communication regarding the form.

- Designate the person being appointed as the agent by filling in their name clearly.

- Select the type of excise tax the agent will be authorized to handle by checking the appropriate box (e.g., sales, use, estate, cigarette, etc.).

- Specify the document requested, including any relevant form number, to clarify what the agent can access.

- Indicate the year(s) or period(s) related to the requested information to ensure accurate retrieval of records.

- The authorized individual who is filling out the form must declare their authority by signing and dating the section provided.

- Record the phone number of the authorized individual for any follow-up communication necessary.

- Ensure that the form is notarized to validate the authority being granted and submit the original document to the Wyoming Department of Revenue.

- Upon completion, save changes to the form, and proceed to download, print, or share the document as needed.

Complete your documentation online now and ensure a smooth process with the Wyoming Excise Tax Division.

Normally, a taxpayer must sign an IRS Form 2848, Power of Attorney and Declaration of Representative, to allow someone to represent them in a tax matter with the IRS -- the representative must also have certain professional credentials.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.