Loading

Get St16 Form Colorado

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St16 Form Colorado online

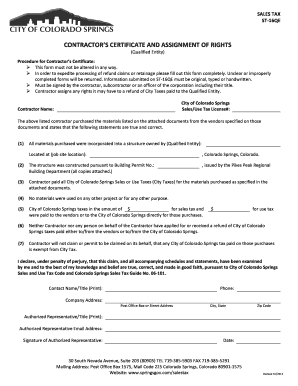

This guide provides a clear and comprehensive approach to filling out the St16 Form Colorado online. Whether you are a contractor submitting a refund claim or a representative of a qualified entity, these instructions will help ensure your form is completed accurately.

Follow the steps to successfully complete the St16 Form Colorado

- Click ‘Get Form’ button to access the St16 Form Colorado and open it in the editor.

- Fill in the Sales/Use Tax License Number of the City of Colorado Springs. This is essential for proper identification regarding your tax status.

- Enter the contractor name in the appropriate field. Ensure that this is the legal name of the entity submitting the form.

- In the next section, confirm the materials purchased for the project listed on the attached documentation. This statement must be accurate, as it asserts compliance with the City of Colorado Springs tax codes.

- Provide the name of the 'Qualified Entity' that owns the structure, along with the job site location in Colorado Springs. Ensure all names and addresses are typed clearly.

- Mention the Building Permit number that corresponds to the construction project. This should be attached with your submission.

- Indicate that all relevant City Taxes have been paid for the materials listed and provide the amounts for sales tax and use tax clearly. If applicable, attach verification documents.

- Certify that neither the contractor nor anyone on their behalf has applied for or received a refund for these taxes already paid.

- Include the contact name and title of the person filling out the form. This information allows for quick communication if needed.

- Complete the authorized representative's details, including their title and email address for correspondence.

- Review all provided information for accuracy. Use spelling and formatting consistent with their requirements.

- Once everything is confirmed, ensure the authorized representative signs the document and dates it before submission.

- Finally, save your changes and choose to download, print, or share the St16 Form Colorado based on your needs.

Complete your development projects efficiently by filling out and submitting the St16 Form Colorado online today.

Colorado allows out-of-state tax-exempt organizations to use the exemption certificate issued by their home state taxing authorities when doing business with Colorado vendors on an occasional basis. No advance notice to the Colorado Department of Revenue is required.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.