Loading

Get A Currency And Monetary Instrument Report Treasury Form 4790

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the A Currency And Monetary Instrument Report Treasury Form 4790 online

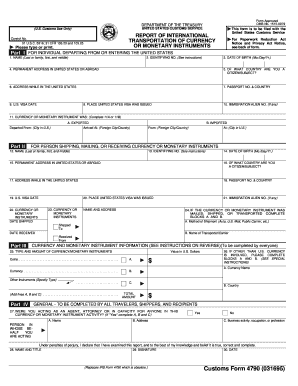

The A Currency And Monetary Instrument Report Treasury Form 4790 is essential for reporting the transportation of currency or monetary instruments into or out of the United States. This guide provides a step-by-step approach to completing the form online, ensuring accuracy and compliance with regulatory requirements.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Fill out Part I with your personal information. You will need to provide your name, identifying number, date of birth, permanent address, citizenship, U.S. address, passport information, visa date, immigrant alien number, and place where the U.S. visa was issued.

- In Part II, indicate whether you are exporting or importing currency. Complete the relevant sections based on your situation, including departure or arrival cities and any associated shipping information.

- Proceed to complete Part III by providing detailed information about the currency or monetary instruments involved. Include the type and amount, as well as values in U.S. dollars.

- In Part IV, answer whether you acted as an agent or attorney for anyone in this activity. If yes, fill in the additional fields regarding the name, address, and business activity.

- Finally, review all entries for accuracy. Sign and date the form where prompted before submitting it. You can then save changes, download, print, or share the form as needed.

Complete your A Currency And Monetary Instrument Report Treasury Form 4790 online for an efficient filing experience.

You may bring into or take out of the country, including by mail, as much money as you wish. However, if it is more than $10,000, you will need to report it to CBP. Use the online Fincen 105 currency reporting site or ask a CBP officer for the paper copy of the Currency Reporting Form (FinCen 105).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.