Loading

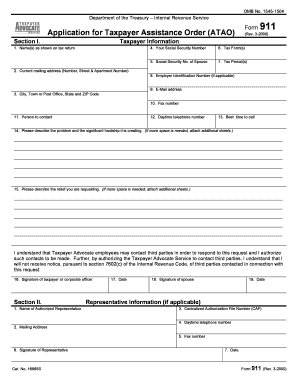

Get Omb No. 1545-1504 Form 911 Application For Taxpayer Assistance ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OMB No. 1545-1504 Form 911 Application For Taxpayer Assistance online

Filling out the OMB No. 1545-1504 Form 911 Application For Taxpayer Assistance online can be a straightforward process when you break it down into manageable steps. This guide provides clear instructions to help you successfully complete and submit the form for tax relief.

Follow the steps to complete your application effectively.

- Click ‘Get Form’ button to obtain the application and open it in your preferred editor.

- Enter your name(s) as they appear on your tax return in the designated field.

- Provide your current mailing address, including street number, street name, apartment number, city, state, and ZIP code.

- Input your Social Security Number in the corresponding section.

- If applicable, enter your spouse's Social Security Number.

- Indicate the relevant tax form(s) that apply to your situation.

- Specify the tax period(s) associated with your application.

- If you have a business, enter your Employer Identification Number.

- Include your email address to facilitate communication about your application.

- Provide your fax number, if available.

- State the name of the person the Taxpayer Advocate should contact regarding your application.

- Fill in your daytime telephone number.

- Indicate the best time for the Taxpayer Advocate to reach you.

- Describe the problem you are facing and the significant hardship it is causing you.

- Articulate the relief you are requesting from the Taxpayer Advocate.

- Sign the form to authorize the Taxpayer Advocate Service to act on your behalf.

- If applicable, complete Section II for any authorized representatives acting on your behalf.

- Review the completed form for accuracy and completeness.

- Once satisfied, save the changes, download, print, or share your completed form as needed.

Take the next step toward resolving your tax issues by completing the OMB No. 1545-1504 Form 911 Application For Taxpayer Assistance online today.

Section 6051 of the Internal Revenue Code requires employers to furnish income and withholding statements to employees and to the IRS. Employers report income and withholding information on Form W-2. Forms W-2AS, W-2GU, and W-2VI are variations of the W-2 for use in U.S. possessions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.