Loading

Get E500 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the E500 Form online

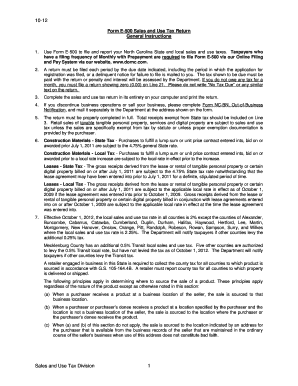

Filling out the E500 Form for sales and use tax in North Carolina can be a straightforward process when you have clear guidance. This document provides a step-by-step approach to completing the form online, ensuring accuracy and compliance with state regulations.

Follow the steps to successfully complete the E500 Form online.

- Click ‘Get Form’ button to obtain the E500 Form and open it in your editing interface.

- Begin filling out the form by entering your gross receipts from business operations in Line 1. Make sure to exclude any taxes collected.

- For Line 2, input the total wholesale sales of tangible personal property sold to registered merchants for resale. Be sure not to include this amount on Line 3 or elsewhere.

- In Line 3, enter the total receipts exempt from state tax, providing accurate examples as needed to justify the exempt status.

- Complete Lines 4 through 12 by entering applicable purchase amounts and calculating taxes due at specified rates. Ensure that you understand the distinction between state and county rates.

- Add up all items from Lines 4 through 12 to determine the total state and county tax on Line 13.

- Review any excess collections on Line 14 and compute your total tax for Line 15 by adding Lines 13 and 14.

- If necessary, include any penalties or interest on Lines 16 and 17 as required based on your filing timeliness and accuracy.

- Fill in any prepayments for the current period and apply credits, if claiming, on Lines 18 and 20.

- Finally, calculate the total amount due on Line 21, ensuring all calculations are accurate before submission.

- Once completed, review your filled-out form thoroughly. Save your changes, and consider downloading or printing a copy for your records before submitting the form online.

Complete your E500 Form online today and ensure timely filing to avoid penalties.

How to File and Pay Sales Tax in North Carolina File online – File online at the North Carolina Department of Revenue. ... File by mail – You can use form E-500 and file and pay through the mail, but North Carolina encourages all sellers to pay online. AutoFile – Let TaxJar file your sales tax for you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.