Loading

Get Declaration Of Insurability For Reinstatement Or ... - Rbc Insurance

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Declaration Of Insurability For Reinstatement Or Change to RBC Insurance online

Filling out the Declaration Of Insurability for Reinstatement or Change to RBC Insurance is an important step in managing your insurance policy effectively. This guide will provide clear instructions to help you confidently complete the necessary form online.

Follow the steps to complete the form efficiently.

- Use the 'Get Form' button to obtain the Declaration Of Insurability for Reinstatement or Change to RBC Insurance and open it in your preferred editor.

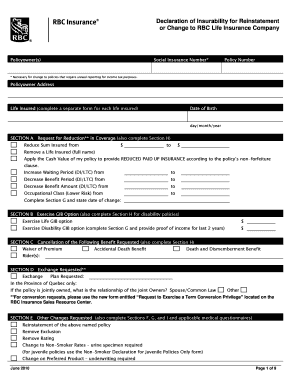

- Begin by entering the policyowner(s) information, including the social insurance number, policy number, and address. Make sure to fill in all required fields accurately.

- For the life insured, provide the individual's full name and date of birth. If there are multiple lives insured, complete a separate form for each individual.

- Proceed to Section A if you are requesting a reduction in coverage. Specify the change in the sum insured and complete the necessary sections as required.

- If you are opting for the Guaranteed Insurability Benefit (GIB) option in Section B, provide the requested amounts and any necessary documentation.

- In Section C, indicate any benefits you wish to cancel. Review the list of options carefully before making selections.

- For Section D, if you are requesting an exchange, specify the plan you are interested in and the relationship of joint owners if applicable.

- In Section E, outline any other changes you wish to make to the policy, including reinstatement or rate changes. Complete the relevant subsections as required.

- Answer all questions in Section F, providing full details for any 'yes' answers. Ensure that you include the name and address of your attending physician if necessary.

- Fill out Section G with employer information and your current occupational status. Specify your duties and confirm if you are actively working.

- Complete Section H if your policy is for disability coverage, providing details regarding eligibility and benefits.

- Finally, in Section I, review the declarations and signatures required. Ensure that all parties have signed the document in the designated areas.

- Once all sections are completed, you can save your changes, download, print, or share the completed form as needed.

Take the next step in managing your insurance by completing the Declaration Of Insurability online today.

The reinstatement cost (also known as rebuild cost or building sum insured) of your home, is the amount it would cost to completely rebuild the property from scratch if it were totally destroyed, by a fire for example.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.