Loading

Get Www Mutualofomaha Lifeportability

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Www Mutualofomaha Lifeportability online

This guide will assist you in completing the Www Mutualofomaha Lifeportability form effectively. By following these instructions, you can ensure that your application for life insurance under the Term Life Portability Plan is accurate and complete.

Follow the steps to successfully complete your application.

- Press the ‘Get Form’ button to acquire the form and display it in your editor.

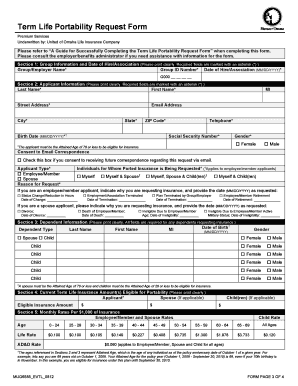

- In Section 1, provide the required employer/group information including the employer's name, ID number, and the original date of hire. Ensure the Group ID Number begins with 'G000' followed by four characters.

- In Section 2, fill out the applicant information accurately. The applicant must be the member or their eligible spouse. Include the necessary personal details such as name, address, date of birth, and consent for email correspondence.

- For Section 3, enter all dependent information. Confirm that they were insured under the group plan before coverage ceased, and ensure their ages meet the eligibility criteria.

- In Section 4, list the current term life insurance amounts eligible for portability for each individual as specified.

- Refer to Section 5 for monthly rates per $1,000 of insurance, and record the applicable rates based on your age category.

- In Section 6, select the type of insurance, provide individual names and insurance amounts, calculate the monthly premium for each, and establish the total premium and billing frequency.

- Designate beneficiaries in Section 7, ensuring the benefit percentages total 100%.

- Finally, read through Section 8 carefully, sign and date the form to confirm your agreement with the conditions outlined.

- Mail the completed and signed form along with your initial premium payment to Mutual of Omaha, making sure to include the group ID on your payment.

Complete your application for portable life insurance today and ensure your coverage continues.

While there is no mandated time frame, some insurance companies can pay out life insurance death benefits in as little as 24 hours for whole life insurance, and 30 to 60 days for a term life insurance policy. Learn more about the basics of life insurance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.