Loading

Get Form 8937 - May 25, 2012 Merger Of Kmi And New Ep - Kinder Morgan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8937 - May 25, 2012 Merger Of KMI And New EP - Kinder Morgan online

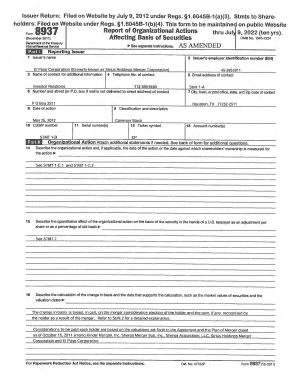

Filling out Form 8937 is essential for documenting the tax implications of the merger between Kinder Morgan Inc. and El Paso Corporation. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and effectively online.

Follow the steps to complete Form 8937 online.

- Click ‘Get Form’ button to access the form for filling out online.

- Indicate the date of action in Part I, Question 5, which should be May 25, 2012. This date reflects the merger event.

- In Part I, Question 10, provide the CUSIP numbers of the securities involved in the merger. The applicable CUSIP numbers include: 283695 87 2, 283905 10 7, and 28336L 10 9.

- In Part II, Question 14, describe the details of the merger action, including the parties involved and the structure of the merger. Clearly explain that the merger is seen as a reorganization for U.S. federal income tax purposes.

- For Questions 15 & 16 in Part II, provide information on the election options exercised by the holders of New El Paso common stock, including cash and stock exchanges along with the corresponding values.

- In Question 17, outline the implications of the merger under relevant tax regulations and how it affects shareholders.

- After completing all sections of the form, review your entries for accuracy, then save your changes, download, print, or share the completed Form 8937 as needed.

Complete your Form 8937 and ensure your tax documentation is accurate and up to date.

Any part of the distribution that exceeds E&P is treated as a non-taxable return of capital (non-dividend distribution) which reduces the shareholder's basis in the stock. If the return of capital exceeds the stock basis, the excess is treated as a capital gain.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.