Loading

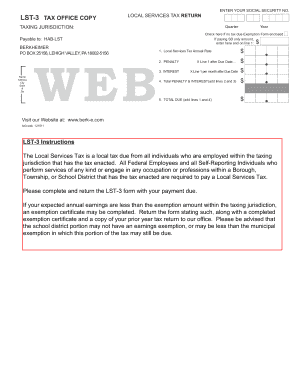

Get Lst-3 Tax Office Copy $ $ $ $ $ $ Lst-3 Instructions The Local ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LST-3 TAX OFFICE COPY online

Completing the LST-3 TAX OFFICE COPY is essential for individuals employed within a jurisdiction that enacts this local tax. This guide will provide you with clear, step-by-step instructions on how to fill out the form accurately and efficiently online.

Follow the steps to complete the LST-3 form.

- Press the ‘Get Form’ button to access the LST-3 document and open it in your preferred editor.

- Enter your social security number in the designated field to ensure proper identification and processing of your form.

- Indicate the quarter for which you are filing the local services tax. Ensure you select the correct quarter to avoid any confusion.

- Specify the taxing jurisdiction where you are employed. This information is crucial to direct your payment to the correct local authority.

- If there is no tax due, check the box indicating an exemption form is enclosed. If you are only paying a specific amount, fill that amount in the appropriate place.

- Complete the fields under the payment section. Begin with line 1 for the local services tax annual rate.

- If applicable, fill in any penalties or interest accrued on lines 2 and 3. These amounts depend on your payment timeline.

- Calculate the total penalty and interest by adding lines 2 and 3. Enter this total on line 4.

- Finalize your payment amount by adding lines 1 and 4 together to get the total due. This will be displayed on line 5.

- Once all sections are completed, review your form for accuracy. You can then save the changes, download the form, print it, or share it as necessary.

Complete your documents online with confidence to ensure timely and accurate submissions.

Related links form

The municipality is required by law to exempt from the LST employees whose earned income from all sources (employers and self-employment) in their municipality is less than $12,000 when the combined rate exceeds $10.00.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.