Loading

Get 2014 Form 990 Or 990-ez (schedule E). Schools - Irs Ustreas

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2014 Form 990 Or 990-EZ (Schedule E). Schools - Irs Ustreas online

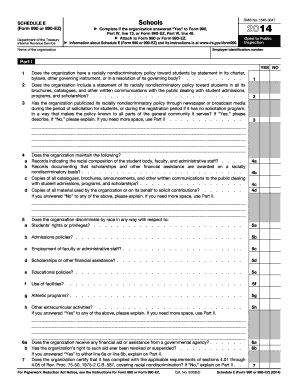

The 2014 Form 990 or 990-EZ (Schedule E) is a crucial document for educational organizations required to report their racially nondiscriminatory policies. This guide provides step-by-step instructions to help users complete the form accurately and confidently, ensuring compliance with IRS regulations.

Follow the steps to fill out your Form 990 Or 990-EZ (Schedule E) easily.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Upon opening the form, begin by entering your organization’s employer identification number and name at the top of the form.

- In Part I, answer the first series of yes/no questions regarding your organization’s racially nondiscriminatory policies. Make sure to provide clear and accurate responses.

- If answering 'Yes' to questions related to publicizing your policy, include specific details in the provided fields. If you need additional space, refer to Part II for supplemental information.

- Complete question 4 by indicating whether your organization maintains specific records related to the racial composition of your institution. Again, use Part II for explanations if necessary.

- Proceed to questions 5 and 6, providing details on any financial assistance received from governmental agencies and the organization’s compliance with applicable regulations.

- Finally, review your responses for accuracy, then save your changes and prepare to download or print the completed form for submission.

Complete your forms online today to ensure timely and compliant submissions.

Yes, the IRS permits electronic filing of Form 990, which includes the 2014 Form 990 Or 990-EZ (Schedule E). Utilizing e-filing can speed up the submission process and ensure that your forms are received promptly by the IRS. Take advantage of e-filing services or platforms like uslegalforms that make the electronic submission process straightforward and efficient.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.