Get Are You Saving Enough Worksheet - American Bank Center

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Are You Saving Enough Worksheet - American Bank Center online

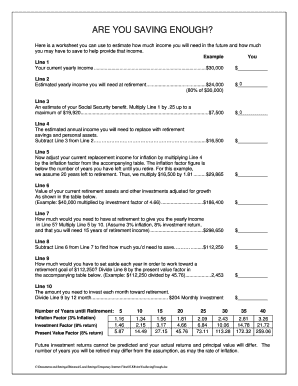

The Are You Saving Enough Worksheet - American Bank Center is a valuable tool designed to help you estimate your future income needs and savings requirements for retirement. This guide provides clear and supportive instructions on how to complete the worksheet effectively.

Follow the steps to complete the worksheet and plan your financial future.

- Click ‘Get Form’ button to obtain the worksheet and open it in your editing tool.

- Start with Line 1 where you will input your current yearly income. This is essential for determining your future income needs.

- For Line 2, estimate the yearly income you will require at retirement. This should be approximately 80% of your current income to maintain your lifestyle.

- In Line 3, estimate your Social Security benefit by multiplying your current yearly income by 0.25, noting the maximum cap.

- Line 4 requires you to subtract your estimated Social Security benefit from your retirement income need to find out the amount you will need to replace with your savings.

- For Line 5, adjust the replacement income identified in Line 4 for inflation using the inflation factor provided in the accompanying table corresponding to your years until retirement.

- In Line 6, estimate the value of your current retirement assets and other investments adjusted for their potential growth using the investment factor.

- Line 7 calculates how much you need by multiplying your adjusted income need from Line 5 by a set factor, taking into account the inflation and return on investment.

- Subtract the value of your assets in Line 6 from the amount needed in Line 7 to find out how much you will need to save, noted in Line 8.

- Determine your annual savings goal in Line 9 by dividing the total savings needed by the present value factor provided in the table.

- Finally, for Line 10, calculate the monthly investment required by dividing the annual savings amount in Line 9 by 12.

- After completing all the sections, save your changes, and you can choose to download, print, or share the final worksheet.

Begin planning for your financial future by completing the Are You Saving Enough Worksheet online today.

The 3 6 9 rule for emergency funds suggests saving three months' expenses for a single individual, six months for a dual-income household, and nine months for those with fluctuating incomes. This guideline emphasizes the importance of tailoring your savings to your unique situation. To implement this rule effectively, refer to the Are You Saving Enough Worksheet - American Bank Center, which can help you create a personalized plan.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.