Loading

Get Mpvattax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mpvattax online

This guide provides detailed instructions for users on how to accurately complete the Mpvattax form online. By following these steps, you can ensure that your application is filled out correctly and efficiently.

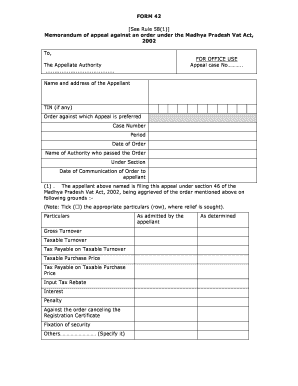

Follow the steps to complete the Mpvattax form

- Click ‘Get Form’ button to obtain the form and open it in an accessible platform.

- Enter your name and address in the designated fields, ensuring all information is accurate to avoid processing delays.

- Fill in the Tax Identification Number (TIN), if applicable, to help the authorities identify your tax records.

- Indicate the order against which the appeal is preferred by entering the corresponding case number, period, and date of order.

- Input the name of the authority who issued the order and the relevant section under which the appeal is being filed.

- Specify the date you received the communication of the order to ensure all timelines are clearly documented.

- In the section for grounds of appeal, tick the appropriate boxes to indicate the particulars where relief is sought; provide any additional details necessary.

- Note the admission amounts in the ‘Extra Demand arising out of Order being appealed’ section, including the amount acknowledged by you and the remaining amount.

- Keep track of the total amount required to be paid under section 46(5) and provide details of the payment made, such as the challan number and date.

- Attach any required documents, including a certified copy of the order being appealed, in the specified section.

- Complete the declaration section with your name, confirming that the information provided is accurate to the best of your knowledge.

- Sign the memorandum of appeal, either personally or via an authorized agent, and date the form.

- Review all entered information for accuracy, then save the changes, or download, print, or share the completed form as needed.

Start filling out the Mpvattax form online today!

Steps to Pay Commercial Tax in Madhya Pradesh Step 1: Visit the Website of MP Treasuries. Step 2: Click on Commercial Tax. Step 3: Fill information asked for. Step 4: Select Bank Name from the List. Step 5: Click on Submit. Step 6: follow instructions on the screen, fill information and Make payment of tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.