Loading

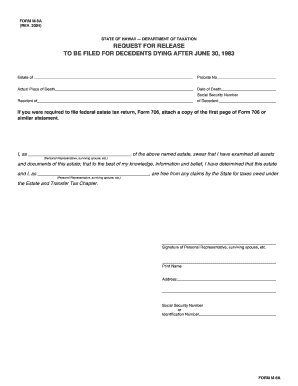

Get Form M-6a, Rev. 2004, Request For Release To Be ... - Formsend

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form M-6A, Rev. 2004, Request For Release To Be Filed online

Filling out Form M-6A is an essential step for managing estate matters in Hawaii. This guide provides you with clear and concise instructions to complete the form efficiently and accurately.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the ‘Estate of’ section with the name of the decedent. Make sure to enter the full legal name as it appears in official documents.

- Next, locate the ‘Probate No.’ field and input the respective probate case number. This is crucial for identification in the probate process.

- In the ‘Actual Place of Death’ field, provide the location where the decedent passed away. This information is necessary for record-keeping purposes.

- Fill in the ‘Date of Death’ by entering the exact date the decedent died. Ensure accuracy, as this date is significant for tax-related considerations.

- The ‘Social Security Number’ field requires the decedent's social security number. This identification number is vital for tax records and should be entered carefully.

- In the ‘Resident of’ section, specify the state where the decedent resided. This is important for determining tax obligations.

- If a federal estate tax return (Form 706) was required, attach a copy of the first page or similar statement, ensuring all relevant information is included.

- As the personal representative or surviving spouse, affirm the information by selecting the appropriate title from the provided options. Make sure to include your printed name.

- Sign the form in the designated area. Your signature certifies that you have reviewed all assets and documents of the estate.

- Finally, input your ‘Address’ and either your ‘Social Security Number’ or ‘Identification Number’ for verification and contact purposes.

- Once all fields are completed, you have the option to save changes, download, print, or share the form as needed.

Complete your Form M-6A online today for a hassle-free estate management process.

Mailing addresses for specific tax forms Type of ReturnAll Districts (Hawaii Department of Taxation)Net Income Tax without paymentP.O. Box 3559 Honolulu, HI 96811-3559Net Income Tax with paymentP.O. Box 1530 Honolulu, HI 96806-15306 more rows • Jan 13, 2023

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.