Loading

Get Broomfield Sales Tax Return P1 - Formsend

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Broomfield Sales Tax Return P1 - FormSend online

Filing the Broomfield Sales Tax Return P1 - FormSend online is an essential task for businesses operating in Broomfield. This guide provides straightforward, step-by-step instructions to help users complete the form accurately and efficiently, ensuring compliance and timely submission.

Follow the steps to successfully fill out the Broomfield Sales Tax Return P1 - FormSend online.

- Press the ‘Get Form’ button to access the form and open it for online editing.

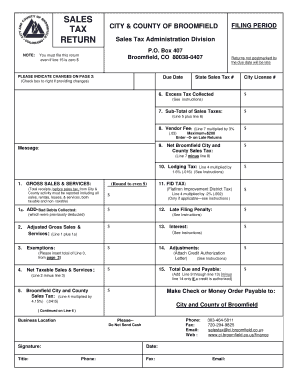

- Begin by entering your State Sales Tax number and City License number at the top of the form.

- Provide details for gross sales and services, rounding to the nearest whole dollar. This includes all taxable and non-taxable sales.

- If there are any bad debts collected that were previously deducted, enter that amount in section 1a.

- Calculate the Adjusted Gross Sales & Services by adding line 1 and line 1a.

- Document any exemptions in line 3, providing details on each specific exemption type listed.

- Determine the Net Taxable Sales & Services by subtracting the total exemptions from the adjusted gross sales.

- Calculate the Broomfield City and County Sales Tax by multiplying the net taxable sales by the tax rate of 4.15%.

- Add the total of excess tax collected, if applicable, to the previous total to get the Sub-Total of Sales Taxes.

- Find the Vendor Fee by multiplying the Sub-Total of Sales Taxes by 3%, with a maximum fee of $200.

- Calculate the Net Broomfield City and County Sales Tax by subtracting the vendor fee from the Sub-Total of Sales Taxes.

- Enter any applicable lodging tax, calculated at 1.6% of line 4.

- List any other fees or adjustments that may apply in the respective sections.

- Total all applicable amounts in line 15 to determine the total due and payable.

- Review all entries for accuracy, and when finished, save your changes, download, print, or share the completed form as necessary.

Start completing your Broomfield Sales Tax Return P1 - FormSend online today to ensure timely submission!

A sales tax of 0.2% applies in the Flatirons Crossing Mall area and the Arista Local Improvement District. Both are collected by Broomfield. A sales tax of 0.5% in Eagle County and . 75% in Summit County.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.