Loading

Get Form Ct-1120 Mec - Formsend

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form CT-1120 MEC - FormSend online

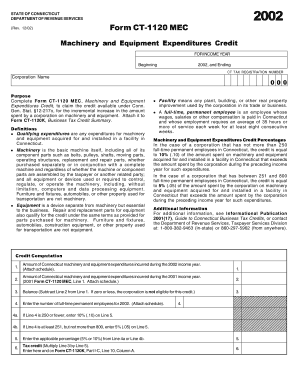

This guide is designed to help you accurately complete the Form CT-1120 MEC for claiming the Machinery and Equipment Expenditures Credit. By following the steps outlined below, you will navigate the online form efficiently, ensuring you capture all necessary information.

Follow the steps to complete the form online.

- Click the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Fill in the income year for which you are claiming the credit by entering the beginning and ending dates in the designated fields.

- Enter your Connecticut tax registration number followed by the corporation name in the appropriate sections.

- Provide the total amount of machinery and equipment expenditures incurred during the specified income year in the first computation line.

- On the subsequent line, enter the machinery and equipment expenditures from the previous income year—this should also coincide with your records from the 2001 income year.

- Calculate the balance by subtracting the previous year’s expenditures from this year’s. If the result is zero or less, the corporation is not eligible for the credit.

- Input the number of full-time permanent employees in the designated section, ensuring to attach any necessary schedules.

- Depending on the number of employees, calculate the applicable percentage (10% for 250 or fewer employees, 5% for 251 to 800 employees) and enter this figure on the next line.

- Multiply the balance from Step 6 by the percentage from Step 8 to determine the tax credit. This final amount should be recorded on the Tax Credit line.

- Once all information is reviewed and accurate, save any changes to the document, and consider downloading, printing, or sharing the completed form as needed.

Start filling out your Form CT-1120 MEC online today to claim your credit.

Use Form CT-1120 EXT, Application for Extension of Time to File Connecticut Corporation Business Tax Return,to request a six-month extension (seven-month extension for corporations with a June 30 fiscal year end) to file Form CT-1120, Corporation Business Tax Return, or Form CT-1120CU, Combined Unitary Corporation ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.