Loading

Get Sc1040a Tax Form For 2004

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC1040A tax form for 2004 online

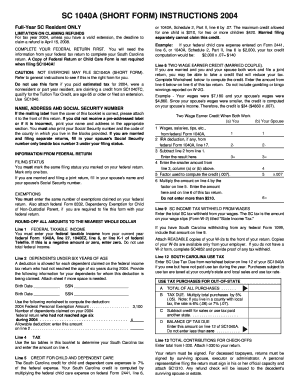

The SC1040A tax form is designed for full-year residents of South Carolina who meet specific eligibility criteria. This guide will provide you with clear, step-by-step instructions on how to complete the form efficiently and accurately online.

Follow the steps to fill out the SC1040A tax form online.

- Click the ‘Get Form’ button to obtain the tax form and open it in your preferred online editor.

- Begin by filling in your name and address in the designated fields. If you have a pre-addressed label, attach it to the front of your return. Make sure to include your Social Security number and the county code where you resides.

- Refer to your federal return to accurately mark your filing status. Ensure that you check only one box corresponding to your filing status.

- Enter the number of exemptions you claimed on your federal return. If applicable, include any necessary federal forms to support your claims.

- Complete the income section by entering your federal taxable income as indicated on your current year federal return.

- Calculate and input any allowable deductions, such as those for dependents under six years of age. Make sure to provide detailed information for each dependent.

- Consult the tax tables provided to determine your South Carolina tax amount. Enter the calculated tax on the relevant line.

- If applicable, compute the credit for child and dependent care expenses based on your federal tax return deductions. Enter this amount in the designated credit section.

- Review all entries for accuracy, rounding all amounts to the nearest whole dollar. Double-check your Social Security number and other personal data.

- Once all sections are complete, you can save changes, download, print, or share your completed form as necessary.

Complete your SC1040A tax form online today for a smooth filing experience.

If you elect to file as a full-year resident, file SC1040. Report all your income as though you were a resident for the entire year. You will be allowed a credit for taxes paid on income taxed by South Carolina and another state. You must complete SC1040TC and attach a copy of the other state's income tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.