Loading

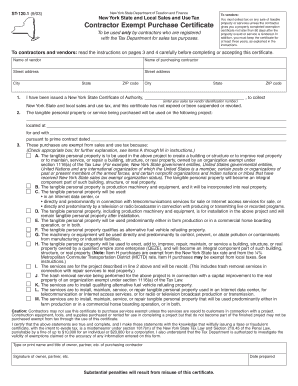

Get 1 (9/03) New York State And Local Sales And Use Tax Contractor Exempt Purchase Certificate To Be

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1 (9/03) New York State And Local Sales And Use Tax Contractor Exempt Purchase Certificate online

Filling out the 1 (9/03) New York State And Local Sales And Use Tax Contractor Exempt Purchase Certificate is essential for contractors seeking to make exempt purchases for construction projects. This guide will provide clear, step-by-step instructions to help you complete the form correctly and efficiently online.

Follow the steps to successfully fill out the form.

- Click the ‘Get Form’ button to access the form and open it for editing.

- In the 'Name of vendor' field, enter the full name of the vendor selling the tangible personal property or service.

- Next, provide the 'Name of purchasing contractor' to indicate who is making the exempt purchase.

- Fill in the 'Street address' for both the vendor and the purchasing contractor, including the city, state, and ZIP code.

- Enter your sales tax vendor identification number in the designated field, confirming that you have a valid New York State Certificate of Authority.

- Describe the tangible personal property or service you are purchasing and indicate the project's location.

- Specify the reason for the exemption by checking the appropriate box corresponding to the detailed categories provided in the form.

- Provide the name and title of the person completing the certificate in the 'Type or print name and title of owner, partner, etc. of purchasing contractor' section.

- Include the signature of the owner, partner, etc., along with the date the form was prepared.

- Review all entries for accuracy before finalizing. After completing the form, you can save changes, download, print, or share the document as required.

Complete your documents online today to ensure compliance and efficiency.

To apply for an initial or renewal tax exemption card, eligible missions and their members should submit an application on the Department's E-Government (E-Gov) system. Applications are generally processed within five business days.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.