Loading

Get Schedule Se Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule Se Form online

Filling out the Schedule Se Form online is a crucial step for individuals with self-employment income to report their self-employment tax. This guide provides a step-by-step approach to ensure accurate completion of the form.

Follow the steps to complete the Schedule Se Form.

- Click 'Get Form' button to access the Schedule Se Form and open it in your preferred online platform.

- Enter the name of the person with self-employment income as shown on Form 1040 in the designated field.

- Input the social security number of the individual with self-employment income in the appropriate field.

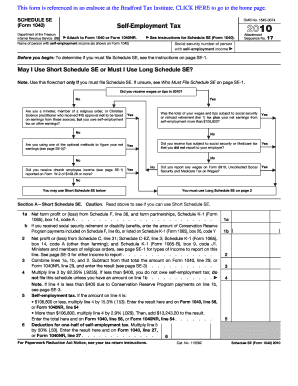

- Review the instructions to determine if you should use the short or long version of the Schedule Se Form. Follow the flowchart included on the form for clarification.

- If using the short Schedule Se, complete Section A by entering net farm profit or loss and any relevant amounts from Schedule C or Schedule F.

- Calculate the self-employment tax based on the instructions provided in Section A and ensure that all figures are accurately multiplied as specified.

- If you are filing the long Schedule Se, proceed to Part I and complete the detailed income reporting as directed.

- Review all completed sections carefully to ensure there are no errors before submitting.

- Once finished, save any changes made to the form, and select options to download, print, or share the completed Schedule Se Form.

Begin filling out your Schedule Se Form online to ensure compliance with self-employment tax requirements.

Schedule SE impacts your taxes by helping you calculate the self-employment tax due on your net earnings. This tax covers Social Security and Medicare contributions, which are essential for your benefits. Completing Schedule SE accurately ensures you meet your tax obligations. If you need assistance, USLegalForms has tools to simplify the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.