Loading

Get City Of Glendale Sales/use Tax Return - Formsend

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the City Of Glendale SALES/USE TAX RETURN - FormSend online

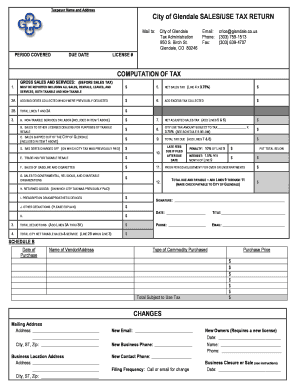

Filling out the City of Glendale sales/use tax return can seem overwhelming, but with a clear understanding of each section, it can be a straightforward process. This guide will walk you through the steps to accurately complete the form online.

Follow the steps to complete the sales/use tax return efficiently.

- Press the ‘Get Form’ button to access the form online and open it for editing.

- Begin by filling in your taxpayer name and address accurately at the top of the form. Ensure all details are correct to avoid processing delays.

- In the ‘Period Covered’ section, indicate the specific period you are reporting for. This information is crucial for proper calculation.

- Enter your license number in the designated field to confirm your business's registration.

- Move to the ‘Computation of Tax’ section. Here, report your gross sales and services before sales tax. This should include all sales, rentals, leases, and services, both taxable and non-taxable.

- Add any bad debts collected (previously deducted) and total these with your gross sales in the appropriate fields.

- Identify any non-taxable services or labor that were included in your gross sales and fill in those amounts.

- Calculate your net sales tax by multiplying the appropriate line by the tax rate of 3.75%, and make sure to include any excess tax collected.

- Complete the adjustments for use taxes applicable to your sales and ensure to calculate total tax due accurately by adding late fees, if applicable.

- Review all entries for accuracy, then sign the form, date it, and provide your title, phone number, and email address as required.

- Finalize your form by saving your changes, and select the option to download, print, or share it as needed.

Start completing your sales/use tax return online today to ensure compliance and avoid penalties.

The minimum combined 2023 sales tax rate for Los Angeles, California is 9.5%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.