Loading

Get It 40x

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the It 40x online

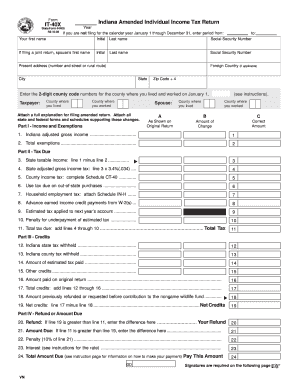

Filling out the It 40x form is an essential step for individuals seeking to amend their Indiana individual income tax return. This guide provides a comprehensive overview and step-by-step instructions to ensure that users can complete the form accurately and efficiently.

Follow the steps to complete your It 40x online.

- Press the ‘Get Form’ button to access the document and open it in the editor.

- Begin by entering your first name, initial, last name, and social security number. If filing a joint return, include your spouse’s first name, initial, last name, and social security number as well.

- Provide your current address, including street number, rural route if applicable, city, state, and zip code. If living outside of the United States, include your foreign country.

- Input the two-digit county codes for the counties where you lived and worked on January 1 of the tax year.

- Attach a full explanation as to why you are filing an amended return, along with all relevant state and federal forms and schedules that support your changes.

- In Part I, report your Indiana adjusted gross income and total exemptions as noted on your original return. Enter the amount of change and the correct amount for each line.

- Part II requires you to calculate your tax due. Subtract total exemptions from your adjusted gross income to find your taxable income. Multiply this by the state tax rate of 3.4%, and complete the following lines based on your circumstances.

- For Part III, list any credits you are eligible for, including state and county tax withheld, estimated tax paid, and other applicable credits. Sum these credits.

- In Part IV, determine if you are due a refund or owe additional tax. Input the necessary calculations to find out your refund or amount due, including any penalties and interest.

- Finally, ensure you sign the document along with your spouse if applicable. Provide contact numbers and the preparer's information if someone assisted you in filling out the form.

- After thoroughly reviewing your completed form and making any necessary corrections, you can save the changes, download, print, or share the form as needed.

Complete your It 40x form online today for a smoother tax amendment process.

If you need to file an Indiana State Income Tax Return Amendment for the current or previous Tax Year or back taxes, you need to complete Form IT-40X. Form IT-40X is a Form used for the Tax Amendment. You can prepare a 2022 Indiana Tax Amendment on eFile.com, however you cannot submit it electronically.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.