Loading

Get Form Ct-5: Request For Six-month Extension To File (for ... - Formsend

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CT-5: Request for Six-Month Extension to File online

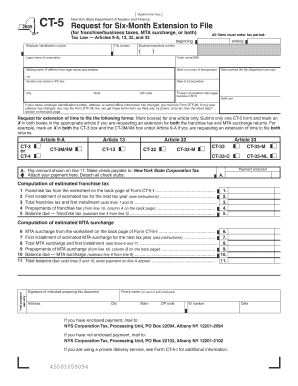

Filling out the Form CT-5 is a crucial step for businesses seeking an extension on their franchise or business tax filings. This guide provides clear, step-by-step instructions on how to complete the form correctly and efficiently, ensuring compliance with New York State regulations.

Follow the steps to successfully complete the Form CT-5.

- Press the ‘Get Form’ button to access the CT-5 form and open it in your chosen editor.

- Enter your employer identification number and file number accurately in the designated fields.

- Fill out the tax period by entering the beginning and ending dates to indicate the duration for which you are requesting an extension.

- Provide your business telephone number in the format (###) ###-#### for contact purposes.

- Enter the legal name of your corporation and, if applicable, the trade name or 'doing business as' (DBA) name.

- If your mailing name differs from the legal name, enter it along with the complete mailing address, including city, state, and ZIP code.

- Indicate the state or country of incorporation and the date of incorporation.

- For foreign corporations, enter the date when you commenced business in New York State.

- Select the articles for which you are seeking an extension by marking the appropriate box(es) for CT forms under Article 9-A, 13, 32, or 33.

- Complete the computation sections for estimated franchise tax and MTA surcharge according to the worksheet provided on the back of the form.

- If applicable, include any payment by checking the appropriate box, making the payment out to New York State Corporation Tax, and attaching it securely to the form.

- Review all information for accuracy, sign the form where indicated, and provide the address of the preparer if applicable.

- Finally, choose to save any changes made, download the completed form, print it for your records, or share it as needed.

Complete your Form CT-5 online today to ensure a timely extension for your business filings.

Yes. Partial payment will be accepted, but the corporation or partnership will be billed for the remaining amount owed plus interest and penalties. Extensions must be accompanied by a properly estimated tax or they will be considered invalid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.