Loading

Get Motor Vehicle Usage Tax Multi-purpose Form (71a101) - Kentucky ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Motor Vehicle Usage Tax Multi-Purpose Form (71A101) - Kentucky online

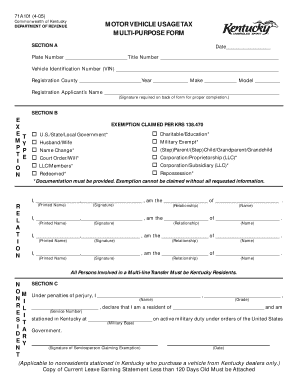

The Motor Vehicle Usage Tax Multi-Purpose Form (71A101) is essential for claiming tax exemptions related to vehicle registration in Kentucky. This guide will assist users through each section of the form, ensuring a smooth online completion process.

Follow the steps to fill out the form accurately and efficiently.

- Press the ‘Get Form’ button to access the Motor Vehicle Usage Tax Multi-Purpose Form (71A101) in your chosen editing platform.

- In Section A, fill in the date, plate number, title number, vehicle identification number (VIN), registration county, year, make, and model of the vehicle. Ensure all details are accurate.

- Continue in Section A by entering the registration applicant’s name. Remember that a signature is required on the back of the form for proper completion.

- Move to Section B, where you will claim an exemption per KRS 138.470. Mark the appropriate exemption type by checking the relevant box and provide documentation as required.

- Complete the relationship and signature fields for each person involved in the exemption. You must print their names and specify their relationship before signing.

- For active military personnel claiming exemption in Section C, fill in your name, grade, service number, and the military installation you are stationed at. A copy of the leave earning statement must accompany this section.

- If applicable, complete Section D for transactions involving modified vehicles. Indicate the purchase price and specify any other modifications or equipment added.

- In Section E, indicate the price of the vehicle excluding trade-in values and the portion attributable to any adaptive devices for individuals with disabilities. Documentation should also be attached.

- Review all sections for completeness and accuracy. Once satisfied, save the changes made to the form, and prepare to download, print, or share as needed.

Complete your Motor Vehicle Usage Tax Multi-Purpose Form online today.

Vehicle(s) must be currently insured with a company that is registered with the Kentucky Department of Insurance to be eligible to renew online. If you have obtained insurance within the last 45 days, your information may not be in our database. This will prohibit you from renewing your vehicle online.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.