Get Download Form Rpd-41287 - Formupack

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Download Form RPD-41287 - FormuPack online

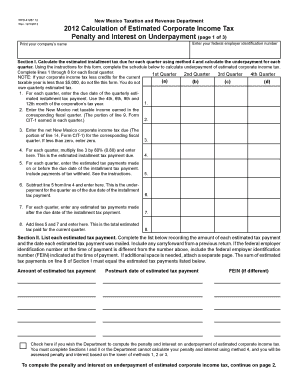

Filling out the Download Form RPD-41287 - FormuPack online can streamline your estimated corporate income tax calculations and ensure compliance with the New Mexico Taxation and Revenue Department. This guide will walk you step-by-step through each section of the form to help you complete it accurately and efficiently.

Follow the steps to successfully complete the Download Form RPD-41287 - FormuPack.

- Select the ‘Get Form’ button to obtain the form and access it in the online editor.

- Enter your federal employer identification number in the designated field. This number is essential for identifying your business to the tax authorities.

- Print your company's name in the required section. Ensure the name matches the one registered with the tax department.

- In Section I, calculate the estimated installment tax due for each quarter using method 4. Follow the instructions to complete the schedule for each fiscal quarter.

- For each quarter, enter the due date of the installment tax payment as the 15th day of the corresponding 4th, 6th, 9th, and 12th months of your tax year.

- Provide your New Mexico net taxable income for each quarter. This should reflect your income earned during that period.

- Enter the net corporate income tax due for each quarter based on the income earned and allowable credits. If the amount is negative, enter zero.

- Multiply the tax due by 80% for each quarter to find your estimated installment tax payment.

- Record timely estimated tax payments made prior to or on the due date. Include any applicable credits.

- Calculate any underpayment by subtracting your timely payments from your estimated installment tax payment.

- List all estimated tax payments made after the due date for each quarter in Section II. Include postmark dates and different FEINs if applicable.

- In Section III, compute interest on underpayments by entering required information for each quarter as outlined in the form.

- Compute penalty for underpayment in Section IV by multiplying underpayment amounts by the appropriate rates based on months late.

- In Section V, sum the total interest and penalties to determine what is owed.

- Once all sections are complete, save changes, and opt to download, print, or share the completed form as required.

Take action now and complete your Download Form RPD-41287 - FormuPack online to ensure your corporate income tax responsibilities are met.

Related links form

Mail this form to the Taxation and Revenue Department, P O Box 25122, Santa Fe, New Mexico 87504-5122. For assistance call your local district office (see back of page for listing). If you wish to change your business address, use Form ACD-31015, Business Tax Registration Application and Update.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.