Loading

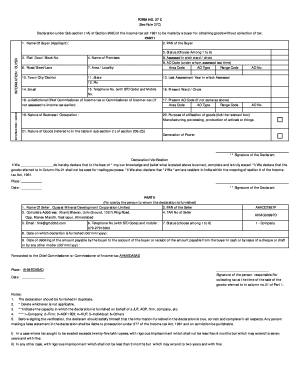

Get Aode Reader Form No27see Rule 37c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Aode Reader Form No27see Rule 37c online

This guide provides a structured approach to completing the Aode Reader Form No27see Rule 37c online. By following these steps, users can ensure that they accurately fill out the necessary information without overlooking any critical details.

Follow the steps to complete the form with ease.

- Use the ‘Get Form’ button to access the Aode Reader Form No27see Rule 37c and open it for completion.

- Begin by entering the name of the buyer in the designated field. This should be the full name as it appears on identification documents.

- Input the PAN (Permanent Account Number) of the buyer. Ensure this number is accurate to avoid processing delays.

- Select the buyer's status from the options provided (choose among 1 to 6). This selection should reflect the legal status of the buyer.

- Fill out the assessed ward or circle where you are currently assessed for income tax.

- Provide the AO (Assessing Officer) code under which you were assessed during the last assessment.

- Complete the address section by providing the flat, door, or block number, as well as the name of the premises.

- Add the road, street, or lane name where the buyer is located.

- Input the area or locality of the buyer's address.

- Specify the town, city, or district of the buyer's location.

- Select the state of residence of the buyer.

- Enter the postal PIN code for the buyer's address.

- Indicate the last assessment year in which the buyer was assessed.

- Provide a current email address for correspondence.

- Fill in the telephone number (including STD code) and mobile number for the buyer.

- Enter the current ward or circle to which the buyer belongs.

- Complete the details for the jurisdictional chief commissioner or commissioner of income tax.

- If applicable, provide the current AO code, area code, AO type, and range code.

- State the nature of the business or occupation of the buyer.

- Tick the relevant box to denote the purpose of the utilization of goods such as manufacturing or processing.

- Indicate the nature of goods according to the table referenced in the form.

- Ensure your signature is provided in the declaration section, confirming the accuracy of the information.

- Finalize the form by saving changes, downloading, or printing for submission.

Complete your Aode Reader Form No27see Rule 37c online today for a smooth filing process.

Form 27C is a declaration form that helps the taxpayer in getting tax exemption from the tax deducted at source (TDS). Form 27C has two sections that need to be filled in and signed by both the buyer and seller.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.