Loading

Get Simple Ira Application - Wells Fargo Advantage Funds

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SIMPLE IRA Application - Wells Fargo Advantage Funds online

Filling out the SIMPLE IRA Application for Wells Fargo Advantage Funds online can be a manageable task with the right guidance. This comprehensive guide provides you with step-by-step instructions to help you complete the application accurately and efficiently.

Follow the steps to complete your application successfully.

- Click the ‘Get Form’ button to obtain the application form and open it in your preferred editing tool.

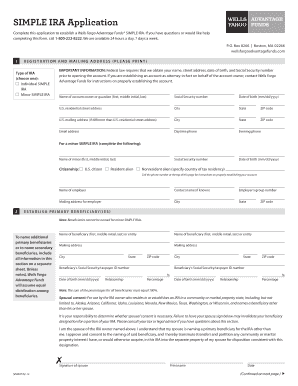

- Begin by selecting the type of IRA you are applying for: either an Individual SIMPLE IRA or a Minor SIMPLE IRA. Ensure to check the appropriate box.

- In the registration and mailing address section, fill in the required fields: name of the account owner or guardian, Social Security number, date of birth, U.S. residential street address, and contact information including email and phone numbers.

- If establishing a minor SIMPLE IRA, provide the minor's name and indicate their citizenship status.

- Enter the name and address of your employer. If known, include a contact name and the employer's group number.

- In the primary beneficiary section, include each beneficiary's full name, mailing address, Social Security or taxpayer ID number, date of birth, relationship to the account owner, and the percentage of the account designated to them. Remember, the total percentage must equal 100%.

- If applicable, obtain spousal consent for naming a beneficiary other than your spouse by having them sign and date the designated section.

- Choose the fund selection for your SIMPLE IRA by indicating how your contributions will be allocated. Specify the fund names and either the dollar amount or percentage of investment for each fund.

- Indicate the contribution type, checking the box that applies to your situation—whether contributions are coming from your employer, a transfer from another SIMPLE IRA, or a rollover.

- Provide bank information if you wish to set up electronic funds transfer options for redemptions. Ensure that the account registration matches your SIMPLE IRA registration.

- Consent to receive electronic documents by providing your consent and acknowledging that you'll receive notifications via email.

- Finally, review the document carefully, sign and date the application, and ensure that all required information is completed before submission.

Start filling out your SIMPLE IRA Application online today to ensure a smooth and efficient process.

Key Takeaways. Traditional IRAs are set up by individuals, while SIMPLE IRAs are set up by small business owners for employees and for themselves. Traditional IRA contributions are made by the individual only, but SIMPLE IRA contributions can be from both an employee and an employer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.