Loading

Get Maryland Form 500d 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Maryland Form 500d 2013 online

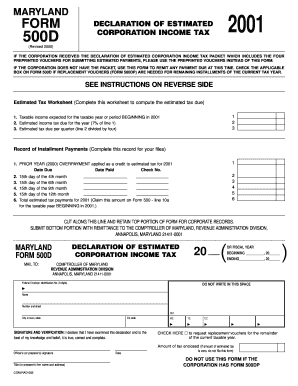

The Maryland Form 500d 2013 is used by corporations to declare and remit estimated income tax when an estimated tax packet is unavailable. This guide provides step-by-step instructions for efficiently completing the form online, ensuring a smooth filing process for all users.

Follow the steps to complete the Maryland Form 500d 2013 online.

- Press the ‘Get Form’ button to access the Maryland Form 500d 2013 and open it in the editor.

- In the designated fields, enter the corporation's name exactly as listed in the Articles of Incorporation, along with any applicable 'Trading As' (T/A) name. Ensure all information is accurately typed.

- Provide the Federal Employer Identification Number (FEIN). If you have not yet secured the FEIN, indicate 'APPLIED FOR' along with the date of application.

- Indicate the applicable taxable year or period by entering the starting and ending dates in the provided spaces.

- Complete the estimated tax worksheet by filling in the expected taxable income for the year (line 1), calculating the estimated income tax due (7% of line 1, line 2), and determining the estimated tax due per quarter (line 2 divided by four).

- Fill in the Record of Installment Payments to keep track of prior year overpayment credits and payment due dates. Ensure you document dates paid and amounts as they are calculated.

- Check the box if you are requesting replacement vouchers for the remainder of the current taxable year.

- In the signature section, ensure that an authorized officer or paid preparer signs and dates the form, also including their title or the name and address of the preparer.

- Enter the amount of tax enclosed, if applicable, and ensure all necessary payments are included when submitting the form.

- At the end, review the entire form for accuracy before saving changes, and then select options to download, print, or share the completed form.

Complete your Maryland Form 500d 2013 online today to ensure timely filing and compliance!

Whether to claim exemption from withholding should hinge on your specific financial circumstances. If you consistently receive a tax refund, it might not be wise to claim it. By using the Maryland Form 500D 2013, you can better assess your expected tax liabilities. Consulting with a tax professional can also provide personalized guidance on this matter.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.