Loading

Get 5106 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 5106 Form online

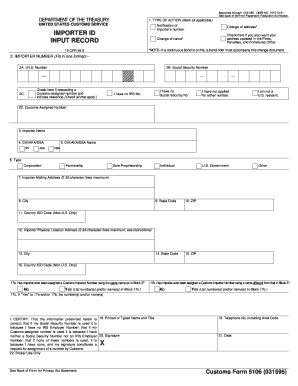

Completing the 5106 Form online is an essential step for importers to establish their identification with the Customs Service. This guide will provide you with clear, step-by-step instructions to successfully fill out the form.

Follow the steps to complete the 5106 Form effortlessly.

- Press the 'Get Form' button to access the 5106 Form and open it in your online editor.

- Begin by marking the type of action you are requesting in Block 1. Check the appropriate boxes for Notification of Importer's Number, Change of Address, or Change of Name as applicable.

- In Block 2, input your Importer Number. If you have an IRS Number, enter it in Block 2A; if you have a Social Security Number, input it in Block 2B. Mark Block 2C if you require a Customs-assigned number and provide the reasons as instructed.

- Input the Importer Name in Block 3. If the name is an individual, provide the last name first, followed by the first name and middle initial. For business names, input in the reverse order.

- If applicable, complete Blocks 4 and 5 with the Division (DIV), Also Known As (AKA), or Doing Business As (DBA) names.

- In Block 6, select the type of company by marking the appropriate box for Corporation, Partnership, or Sole Proprietorship.

- Fill out the Importer Mailing Address in Block 7, ensuring to adhere to the 32-character limit for each of the two lines.

- Provide the City, State Code, and ZIP Code in Blocks 8, 9, and 10 respectively, using the correct codes as detailed in the form.

- For foreign addresses, complete Block 11 with the Country ISO Code. Block 12 is for the Importer Physical Location Address; it must differ from the mailing address if using a post office box.

- Continue filling out the business address in Blocks 13 to 16, ensuring all codes are entered accurately.

- In Block 17, answer the questions regarding any previously assigned Customs Importer Number by checking 'Yes' or 'No' for each statement.

- Complete the certification statement by entering your Printed or Typed Name and Title in Block 18, and sign in Block 20.

- Finally, review all your entries for accuracy, then save your changes. You can download, print, or share the completed form as needed.

Start filling out your documents online today to ensure a smooth import process.

Do I still need to fill out the CBP Form 5106? Registering as an Importer of Record (IOR) with CBP is necessary if an entity intends to be involved as an importer, consignee/ultimate consignee, sold to party, 4811 party, etc. on an informal or formal entry.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.