Loading

Get 9211 Form Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 9211 Form IRS online

Filling out the 9211 Form IRS online can seem daunting, but with the right guidance, it becomes a manageable task. This comprehensive guide is designed to walk you through each section of the form to ensure you complete it accurately and efficiently.

Follow the steps to complete the 9211 Form IRS online.

- Press the ‘Get Form’ button to access the form and open it in the editor.

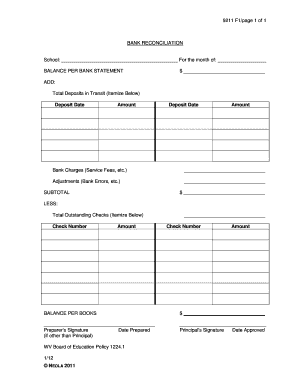

- In the first section, enter the name of the school and the month for which you are reconciling the bank statement.

- Input the balance as per the bank statement in the designated field.

- List down the total deposits in transit. For each deposit, include the deposit date and the corresponding amount.

- Record any bank charges such as service fees in the specified area.

- Note any adjustments for bank errors in the provided section.

- Calculate the subtotal by adding the balance per bank statement to the total deposits in transit, bank charges, and adjustments.

- Deduct the total outstanding checks by listing each check number and amount.

- Input the final balance per books once all calculations are complete.

- Have the preparer sign and date the form. If applicable, the principal must also sign and date to approve the entries.

Complete your documents online today and ensure accuracy in your financial reporting.

The Internal Revenue Service extends a special credit to older taxpayers called the Credit for the Elderly or the Disabled. This tax break allows individuals and couples to reduce the amount of their income tax by their allowable credit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.