Loading

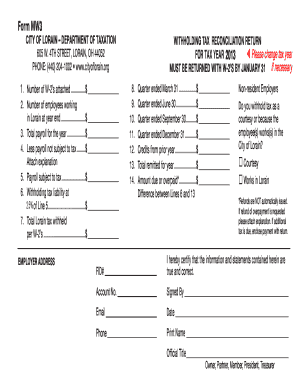

Get City Of Lorain Form Mw3

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the City Of Lorain Form Mw3 online

Filling out the City Of Lorain Form Mw3 online is a straightforward process that requires careful attention to detail. This guide will provide you with step-by-step instructions to ensure your form is completed accurately and submitted on time.

Follow the steps to successfully complete Form Mw3 online.

- Click ‘Get Form’ button to access the form and open it in your preferred online editor.

- Review the general information provided on the form. Ensure you have your employee data, including the number of employees working in Lorain at year-end, as well as payroll details.

- Fill in the number of employees working in Lorain at year-end in the space provided.

- Enter the total payroll for the year. This information is critical as it affects your tax calculations.

- Deduct any payroll amounts not subject to tax and attach a brief explanation if necessary.

- Calculate the payroll subject to tax by subtracting the non-taxable payroll from the total payroll for the year.

- Determine your withholding tax liability at 2.5% by calculating 2% of the payroll subject to tax.

- Complete the section for the total Lorain tax withheld per W-2 forms and list the number of W-2 forms attached.

- Provide calculations for any quarterly breakdowns as indicated in the form. This includes figures for each quarter of the year.

- If applicable, indicate whether the withholding tax was a courtesy or because the employee works in the City of Lorain.

- Certify the information contained in the form by signing and filling in your official title, date, email, and phone number.

- Review all entries for accuracy before proceeding to save, download, print, or share the form as needed.

Complete your City Of Lorain Form Mw3 online today to ensure timely filing and compliance.

The minimum combined 2023 sales tax rate for Lorain, Ohio is 6.5%. This is the total of state, county and city sales tax rates. The Ohio sales tax rate is currently 5.75%. The County sales tax rate is 0.75%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.