Loading

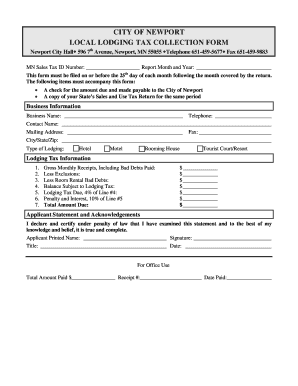

Get Local Lodging Tax Collection Form - City Of Newport, Mn

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Local Lodging Tax Collection Form - City Of Newport, MN online

This guide provides a comprehensive overview of how to accurately complete the Local Lodging Tax Collection Form for the City of Newport, MN. Our step-by-step instructions will facilitate the online submission process, ensuring you fulfill your tax obligations efficiently.

Follow the steps to complete the Local Lodging Tax Collection Form online.

- To begin, locate the form by selecting the 'Get Form' button. This action will open the document for you to edit.

- In the Business Information section, enter the name of your establishment, telephone number, contact person's name, mailing address, and fax number. Ensure all details are accurate to avoid any processing issues.

- Specify your establishment's type by selecting from options such as hotel, motel, rooming house, tourist court, or resort.

- Proceed to the Lodging Tax Information section and complete Line 1 by reporting the total gross monthly receipts from lodging sales for the reporting month.

- Move to Line 2 to list any exclusions. This may include revenues received from lodging stays longer than 30 days, amounts for non-lodging real property use, and lodging paid for by the federal government or foreign consular officials.

- For Line 3, enter any uncollectible room rental debts to reflect realistic earnings for the month.

- Calculate the balance subject to lodging tax by adding lines 1 through 3 on Line 4.

- To determine the lodging tax due, multiply the amount in Line 4 by 4% and record this amount in Line 5.

- If applicable, calculate penalties and interest for late payment by multiplying the amount in Line 5 by 10% and fill in Line 6.

- Finally, add the amounts from lines 5 and 6 to arrive at the total amount due, and record this in Line 7.

- Review all entries for accuracy. After ensuring the form is complete, you may save your changes, download, or print the form as needed.

Complete your Local Lodging Tax Collection Form online today to stay compliant!

Related links form

Unorganized territories. A county board acting as a town board with respect to an unorganized territory may impose a lodging tax within the unorganized territory ing to this section if it determines by resolution that imposition of the tax is in the public interest.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.