Loading

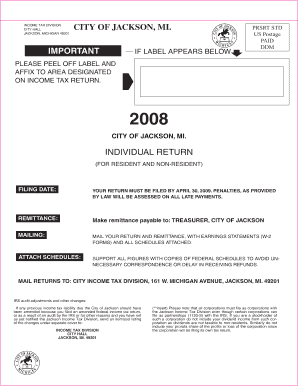

Get J1040 Instructions Jackson Mi

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the J1040 Instructions Jackson Mi online

Filling out the J1040 Instructions for Jackson, Michigan, can be straightforward with the right guidance. This comprehensive guide will help users navigate through each section and field of the form while providing clear, step-by-step instructions tailored to diverse needs.

Follow the steps to successfully complete your J1040 Instructions online.

- Click the 'Get Form' button to obtain the form and access it in your preferred digital format. This allows you to begin the process of filling out the J1040 Instructions.

- Begin by entering your personal information in the designated fields, including your last name, first name, social security number, and address. Make sure to check the correct filing status box (resident, non-resident, or part-year).

- In the exemptions section, indicate any dependents and their corresponding social security numbers. Ensure to provide additional details if you are claiming exemptions related to age or disability.

- Proceed to report your total income. Collect all W-2 forms and other earnings documents to accurately enter the total gross income for the year.

- Complete the addition and subtraction schedules as required, detailing any adjustments to your income. Make sure to attach any necessary federal schedules to support your claims.

- Calculate your adjusted income and tax according to the instructions provided in the J1040 Instructions document. Ensure you are applying the correct tax rates for residents and non-residents.

- Review your entries for accuracy. Ensure all required attachments, such as W-2 forms and other supporting documents, are included.

- Finally, save your completed form. You can opt to download it for printing, share it, or submit it online depending on the available submission methods. Refer to the mailing address provided for any necessary payments.

Complete your J1040 Instructions online today to ensure accurate and timely filing.

Michigan (MI) Payroll Taxes for 2023 Michigan has a single income tax rate of 4.25% for all residents. Simple enough. But these cities charge an additional income tax ranging from 1.0% to 2.4% for Michigan residents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.