Loading

Get Sa970 File On Line Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sa970 File On Line Form online

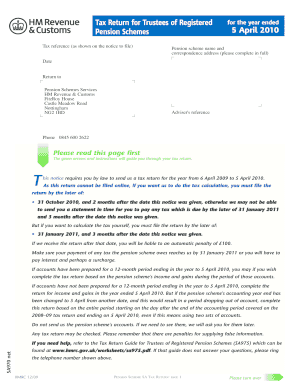

Filing the Sa970 File On Line Form can seem daunting, but with this guide, you will be able to navigate each section and field with confidence. This document outlines the essential steps required to successfully complete the form online, ensuring compliance and accuracy in your tax return.

Follow the steps to complete the Sa970 File On Line Form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your tax reference as shown on the notice to file. This is crucial for identifying your pension scheme.

- Fill out the date for the year ended 5 April 2010. Ensure the date is accurate to avoid any discrepancies.

- Complete the pension scheme name and correspondence address fully. This information should be precise, as it establishes your scheme's identity.

- In the adviser’s reference section, provide any relevant reference number, if applicable.

- Answer questions about income for the year ended 5 April 2010, starting from question 1 regarding income from which UK Income Tax has been deducted.

- Continue through the form, providing information about specific income types such as trading income, income under a Deed of Covenant, and any other taxable income.

- Complete the sections for repayments if applicable, ensuring to check the correct boxes for the instruction related to bank details.

- Provide your contact details in the final sections, including your name and phone number, for HM Revenue & Customs follow-up inquiries.

- Before submission, review the information thoroughly to ensure accuracy and completeness. Once confirmed, you may save changes, download, print, or share the form.

Take action now and complete your Sa970 File On Line Form online to ensure timely submission.

To file the income tax return (ITR) for taxable retirement benefits, individuals need to include the income from such benefits under the head "Income from Salary" in their ITR form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.