Loading

Get Sa370 Notes

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sa370 Notes online

Filling out the Sa370 Notes online is an essential step for users involved in the Self Assessment tax process. This guide will provide clear and supportive instructions to help you navigate the online form efficiently.

Follow the steps to fill out the Sa370 Notes online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by filling in your personal information as requested in the designated fields. Ensure that your Unique Taxpayer Reference (UTR) is accurately entered.

- Provide details related to your income and any allowances or deductions that apply to you. Be as precise as possible to minimize errors.

- Review all entries thoroughly to confirm the accuracy of the information provided. It is crucial to check for any discrepancies that may impact your assessment.

- Once you have filled out all necessary fields and confirmed the details, proceed to save your changes. You may have the option to download, print, or share the completed form.

Complete your Sa370 Notes online today to ensure timely tax compliance.

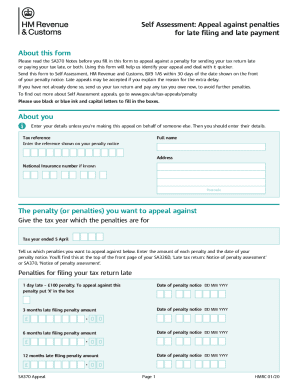

Penalties for paying your tax late If you delay paying your tax by: 30 days — you'll have to pay 5% of the tax you owe at that date. 6 months — you'll have to pay a further penalty of 5% of the tax you owe at that date.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.