Loading

Get 2010 M1w, Minnesota Income Tax Withheld

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2010 M1W, Minnesota Income Tax Withheld online

Completing the 2010 M1W, Minnesota Income Tax Withheld form online is a straightforward process that will help you report your Minnesota income tax withheld accurately. Follow this guide for clear, step-by-step instructions to ensure you fill out the form correctly.

Follow the steps to fill out the 2010 M1W form online.

- Click ‘Get Form’ button to access the form and open it in your online editor.

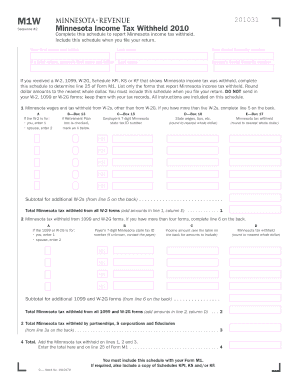

- In the first section, enter your personal information, including your first name, initial, last name, and Social Security number. If you are filing a joint return, also include your spouse’s details.

- For line 1, report the Minnesota wages and tax withheld from your W-2 forms. If you have more than five W-2s, complete the additional information on line 5 at the back of the form.

- Check box A or B in line 1 based on whether the W-2 is for you or for your spouse. If applicable, round the Minnesota tax withheld to the nearest whole dollar.

- Continue to line 2 to report any Minnesota tax withheld from 1099 and W-2G forms. If you have more than four forms, complete line 6 on the back.

- For line 3, input any total Minnesota tax withheld by partnerships, S corporations, and fiduciaries as indicated.

- Add the totals from lines 1, 2, and 3 for line 4. This total is crucial as you will need to enter it on line 25 of Form M1.

- Make sure to include this schedule with your Form M1 when filing your return. If you are required to submit additional schedules (KPI, KS, or KF), ensure they are included as well.

- Review all entered information for accuracy before saving your changes. You can then download, print, or share the completed form for your records.

Complete your Minnesota Income Tax Withheld form online to ensure accurate reporting and compliance.

You can report withholding tax by filing the appropriate forms, including the 2010 M1W, Minnesota Income Tax Withheld. It is essential to gather all necessary documentation and ensure that your reported income reflects the withholding accurately. If you need assistance, consider using resources like the US Legal Forms platform to guide you through the reporting process smoothly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.